Clash Royale: Is Supercell shooting itself in the foot?

Patrick Walker, EEDAR's VP of Insights, argues that the game's success may cannibalize Clash of Clans and be bad news for Supercell in the long run

In March, after years of stagnation at the top of the mobile grossing ranks, a mobile game with truly innovative gameplay finally broke through to the top of the charts. Clash Royale, Supercell's clever hybrid of Tower Defense, MOBA, and Card Battle gameplay found near-instant success, becoming the top grossing game in the world in its first month on the market. Successful innovation in mobile is hard, but it is unsurprising that Supercell was able to accomplish the feat. In addition to possessing the resources to support large-scale user acquisition, the Finnish mobile giant has talented teams, a massive amount of user data, and the luxury of ongoing revenue to support its high rate of killing underperforming prototypes.

The cleverness of the Clash Royale design has been a hot topic of conversation since the game's release, but EEDAR views the following factors as the most important to its success:

- Accessible but deep gameplay. A simple map layout and intuitive controls make getting started easy. Complexity in unit behavior, unit strengths, and the meta-game of deck collection make the game deep and difficult to master (while also masking pay-to-win elements). In addition, creating a mid-core game designed for portrait orientation leverages the trend in rising phone versus tablet use.

- Quick synchronous multiplayer. Synchronous multiplayer games often violate a golden rule in mobile - if you are going to have session lengths longer than a few minutes, you'd better be Blizzard. Clash Royale has a short match length of 3 minutes, and this is engineered to make the final minute especially exciting. In addition, the title has simple, polished assets which reduce match loading time and data usage.

- A new take on tried-and-true monetization. Uses wait-timer monetization through the chest system rather than a pure card collection mechanic. This combines the psychologically compelling gacha mechanic with all the benefits of wait-timer monetization, including built-in reasons for players to return regularly and less dependence on developer-produced content.

- Social is deeply integrated into the experience. A card trading mechanic between clan members makes social gameplay an integral part of level advancement. Short, exciting battle structure and an integrated viewing channel create a compelling spectator mode.

However, despite the initial success of Clash Royale there is a risk that the game could have an overall negative impact on Supercell revenues by cannibalizing Clash of Clans. Clash Royale uses the cartoony Clash of Clans IP, a brand that has reached mainstream penetration on the back of a massive multi-year television campaign. The strength of the Clash of Clans brand has played a major role in Clash Royale's success, but it also means that many players will likely transition from Clash of Clans to Clash Royale. This gives Clash Royale some pretty big shoes to fill long-term, and there are early signs that Clash Royale may have trouble replicating the long-term dominance of Clash of Clans.

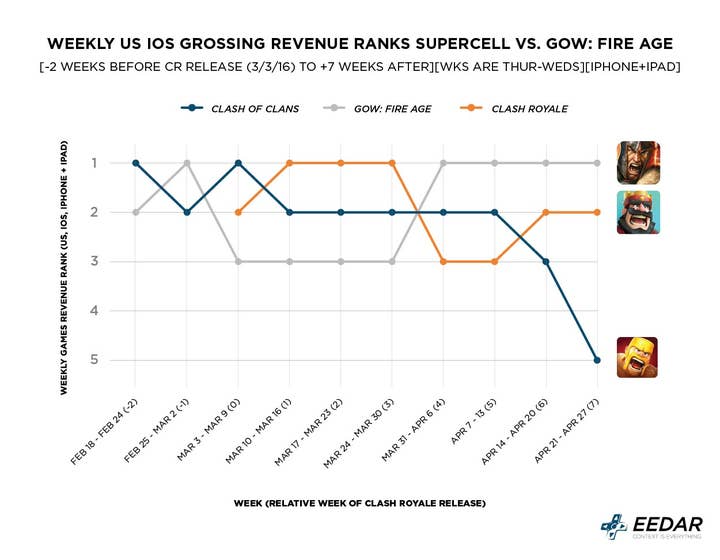

First, there are already signals that the long-term revenue outlook for the Clash titles may not match the short-term hype. While Clash Royale jumped to the top of the global charts in March, this came at the expense of Clash of Clans and was followed by both titles sliding in April, especially Clash of Clans. The following graph shows the weekly performance of the two titles versus GoW: Fire Age in March and April in the United States on iOS.

The graph shows a tale of three time periods. After years of Clash of Clans dominating the top spot (and more recently flip-flopping with GoW:Fire Age), the release of Clash Royale on March 3rd kicked off a tremendous March for Supercell, with the two Supercell titles occupying the top 2 ranks. However, April was another story, as Clash Royale lost the top spot for several weeks and Clash of Clans slipped down the US charts for the first time in years. While this graph shows US iOS data only, the US market is a significant percentage of revenue for Western-developed titles and often leads revenue trends that follow in other markets.

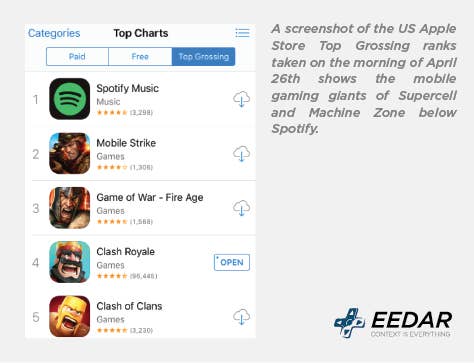

A sign of the dropping revenues across these Supercell titles was their rankings sliding below Spotify, a subscription-based music service, on the top-grossing chart in April. Services like Spotify generally have more stable short-term revenue than IAP-driven F2P games and can be viewed as a benchmark when games shift rank above and below the service.

There is a risk that the more core Clash Royale gameplay will provide an exit ramp for Clash of Clans players out of the Supercell ecosystem. The data suggests that Clash of Clans is a major pipeline for introducing players to Clash Royale, whether directly or indirectly. EEDAR research suggests that most North American Clash Royale players have played Clash of Clans (74 percent)... and significantly, almost 40 percent of Clash Royale players (37 percent) are active Clash of Clans players, having played the game in the past month. The high overlap between the two titles makes it unsurprising that Clash of Clans revenues have dropped with the emergence of Clash Royale.

A major risk to Supercell is that many players who enjoy the mid-core city building gameplay of Clash of Clans may not enjoy the slightly more core synchronous multiplayer gameplay of Clash Royale. Although the industry often gets frustrated by the use of the words "core" and "casual" they are valuable for understanding market dynamics. EEDAR uses the terms casual, mid-core, and core to define how much investment (time, money, concentration, etc.) a game requires from the player. There is a strong correlation between the level of investment required by a game (i.e. "coreness") and the market size of potential players.

The breakthrough in mid-core game design is driving deep engagement through many, short sessions which do not require as much investment as the longer play sessions of traditional HD games. Even though the Clash Royale battles are short, there is a higher focus needed in a Clash Royale multiplayer match than a raid in Clash of Clans. There is a risk that this type of gameplay will not appeal to many transitioned Clash of Clans players long-term.

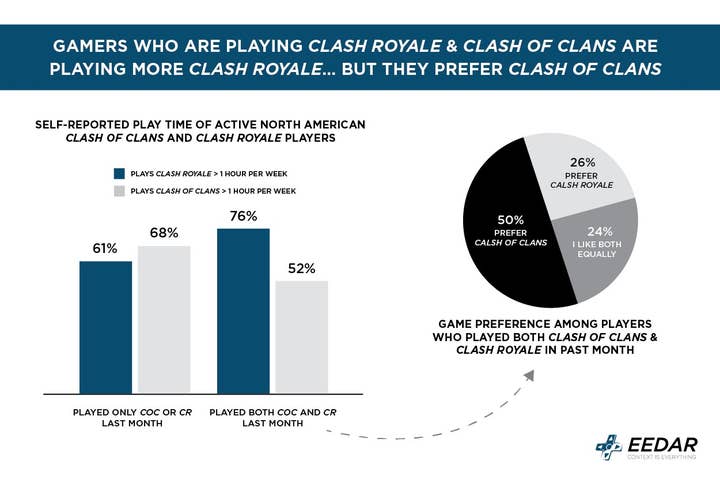

EEDAR consumer data collected in April suggests there may be merit to the risk of cannibalization. The players that play both Supercell titles are playing significantly more Clash Royale than Clash of Clans and are the most engaged group across the two games. However, despite the high Clash Royale engagement, the majority of players playing both titles prefer Clash of Clans.

Will players that prefer Clash of Clans return to that game or exit the Supercell ecosystem? The risk of churn when transitioning gamers to a new game has a long history in the games industry. The release of Everquest 2 created an ideal opportunity for Everquest players to stop playing the game and try World of Warcraft. Unfortunately, many of them liked World of Warcraft better than Everquest 2, and a new dominant MMORPG emerged. Unlike SOE, Blizzard has opted to release a consistent string of updates and expansions for World of Warcraft rather than a sequel.

Supercell faces a similar risk with the migration of their Clash of Clans audience to Clash Royale. If a subset of these users don't enjoy the experience in Clash Royale as much as Clash of Clans, the big question is this: will they go back to Clash of Clans, or is this the beginning of the end of Supercell dominance?