Is your publishing agreement fair?

At GDC Summer, lawyer Kellen Voyer broke down the average indie game publishing agreement in 2020

If you're a relatively new developer signing your first publishing agreement, you're at a two-fold disadvantage, according to Voyer Law's Kellen Voyer.

For one, you may not know what key publishing agreement terms mean, and you also probably don't know what terms are standard, and what terms aren't. While you might hear from a publisher that a certain clause is a "standard" clause, it may be difficult to determine the accuracy of that if you have no reference points.

In a talk at GDC Summer this week, Voyer shared data he collected through working with video game companies and publishing agreements to help democratize the required information. The dataset included analysis of seven key points across a total of 30 publishing agreements. All titles involved were independently developed, none were mobile games, and almost all the publishers were unique -- repeat publishers were included only if they had multiple deals with very different terms. Additionally, the data did not include porting or localization deals.

"There's this common perception that the publisher is someone who is adverse in interest to the developer," Voyer began. "I think part of that comes from just a lack of information on the developer side as to how these agreements work and what's standard and what's not standard.

"Since the publisher knows everything and the developer knows little, it's easy to understand how this kind of adversarial relationship or perception may develop. So we want to try to improve those relations."

Advance

First, Voyer covered advances, or the amount of money developers get from publishers at the onset of the deal to fund the development of a game.

The average amount of advance money across all deals was $318,000, though this data also included deals that had no advance at all. With only deals that included advances taken into account, the average advance was $460,000.

The deals that had advances ranged from $100,000 on the low side, all the way up to $2 million. Only 18% of all the deals didn't have an advance included, but Voyer mentioned that these deals were often advantageous in other ways, which he'd address later in the presentation.

"When you have a really large advance and you're not going to be paid a revenue share until the advance is recouped, if your game isn't successful, they never pay you a single dollar"

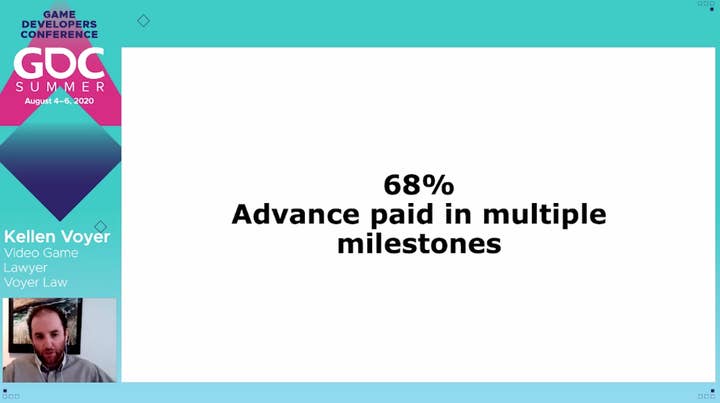

In 68% of all the deals, an advance was paid over multiple milestones. Voyer noted that while this is common, developers should keep an eye on what those milestones are and how they're outlined in the contract. The publisher is going to be the one determining whether milestones are met or not, he said, so make sure these milestones are very specific and acceptable to you.

Meanwhile, 32% of the deals had advances paid in a lump sum. These deals were most often made with new, upcoming platforms that were trying to draw new developers, and they also tended to sync up with very lucrative advances.

Another key question with advances was whether or not they needed to be recouped. In 81% of cases they did -- the ones that didn't were often the aforementioned new platform deals. In 58% of these deals, the advance was recouped while both developer and publisher were getting paid, but in 42% revenue share only kicked in after the publisher had fully recouped their advance.

"This is concerning," Voyer said. "This kind of clause means that the developer won't see one dollar until the publisher is fully repaid. And if you think about this, this can get quite detrimental. When you have a really large advance -- imagine a $500,000 advance -- and you're not going to be paid a revenue share by the publisher until the advance is recouped, if your game isn't successful -- that game that you worked three years to build -- they never pay you a single dollar. So I'm always concerned to see those kinds of clauses."

Revenue Share

The next clause Voyer discussed was revenue share, or the amount of money the studio keeps versus what the publisher keeps. He opened by noting a discussion he'd seen on social media during past GDCs about whether or not studios were getting screwed over on 50/50 revenue share deals, then said that based on the deals he looked at, 50/50 revenue shares were not that common.

Rather, the average revenue paid to developers in Voyer's data was 60%, with the publisher receiving 40%. And, he added, this is where studios with no-advance deals tend to have an advantage. In the no-advance deals he looked at, 71% was the average revenue paid to developers, with some deals reaching 80% or even 90% to the developer. Often, these games were almost ready to be released when the deal was brokered, and the developer was mainly looking for marketing, exposure, or community management rather than pure funding.

For deals with an advance, the average revenue going to the developer was 55%. He also noted that this average was effectively the same regardless of the size of the advance, so while having an advance or not impacted the revenue share, the amount of the advance did not.

Additionally, 45% of the deals Voyer looked at saw revenue share vary over a term. For these deals, on average, 68% of revenue was paid to the publisher while the advance was recouped. But after recoup, that switched to an average of 40% paid to the publisher and 60% to the developer.

For this reason, Voyer recommended pushing back on 50/50 revenue shares, and suggested that a 60/40 in the publisher's favor until full recoup, with 40/60 after recoup, might be an acceptable compromise to many publishers.

IP Ownership

The IP ownership issue is fairly straightforward, Voyer said. In 93% of the contracts he looked at, the developer owned the game -- and he was adamant that developers should never give up IP rights. However, 22% of the deals he looked at had a "transfer on breach" clause.

"The publisher always has the upper hand in [transfer on breach], because it's the publisher who defines breach"

"What happens in these clauses is if the developer breaches the terms of the publishing agreement, they may have to give up ownership of the game," he said. "For example, if they don't deliver the game on time, then they may have to give up ownership of the game. And that's difficult, because especially with development timelines, there's oftentimes when they're going to be extended for reasons that are wildly variable. And if that's one of the reasons you could be forced to give up ownership of the game, that's pretty concerning.

"The publisher always has the upper hand in these clauses, because it's the publisher who defines breach. If the publisher says it's breached and takes control of the game, what are your options? You could sue the publisher, but most of our clients don't have the financial resources to do that. So be careful about that."

Sequels

There are effectively two types of sequel clauses, Voyer said, and 68% of the contracts he looked at had one or the other.

The first type of clause is the right to negotiate, which Voyer said is a good approach. Essentially, this is right of first refusal -- if the developer wants to make a sequel, they bring it to the publisher, have a set period to hash it out, and if they don't reach an agreement the developer can take it elsewhere.

However, Voyer was far more negative about sequel options.

"Imagine you agreed to 50/50. Your game is wildly successful. If you are locked into the same sequel terms, you'd have to do a 50/50 deal on your next game"

"A sequel option is a clause where the publisher is notified about a sequel, and they get to choose if they publish the game," he said. "And this is unfortunate because you're stuck in a relationship for future titles. Imagine if you're not comfortable working with a publisher anymore. Maybe their market reputation went down. Maybe they didn't pay the royalties on time. Could be a whole series of reasons why you may not want to continue that relationship, but the option forces you to stay in that."

Voyer also advised developers never to lock in sequel terms in a game contract, and especially avoid agreeing that sequels rights will be on the same terms as the initial agreement.

"Imagine you had a brand new studio and your first game, so you agreed to 50/50 [revenue share], just to get financed. Your game is wildly successful. Well, if you are locked into the same sequel terms, you'd have to do a 50/50 deal on your next game. And that could be a game that's going to be wildly successful with publishers clamoring to publish it, yet you'd be stuck working under really negative terms. It'd probably inspire you not to make this sequel."

Term/Duration

The average term of a deal that Voyer looked at lasted about six and a half years, and he noted that for the most part, negotiation did not lower that number by very much -- only by one or two years maximum.

Of those, 64% were fixed terms, while automatic renewal was less common. Though fixed term negotiation isn't especially negotiable, Voyer recommended pushing for lower renewal duration on automatic renewals. One year is fine, but two or more years can cause problems, especially if developers don't keep track of when their renewal is coming up.

Additionally, 38% of the deals had perpetual terms, which Voyer said developers should not accept. Not only can it become an issue when developers want control of their games again -- such as for an HD version down the line or similar -- it can also be enormously problematic if combined with a right to publisher sequels, potentially forcing developers to be stuck with a single publisher for an entire series forever.

Audit Clause

Voyer recommended always negotiating an audit clause. It was in 79% of the deals he looked at, and as he said, it should be in all of them. Audit clauses give developers a way to ensure the publisher is paying them correctly. Essentially, developers have an agreement that an accountant can inspect the publisher's books, and if there is a shortfall, the publisher must pay it back.

"You don't want to figure out that you were shorted by a publisher and have no recourse for it"

"You want to make sure that the publisher isn't improperly calculating funds," he said. "Not to say the publisher is a bad actor, but simply, accounting departments mess this up all the time. You don't want to figure out that you were shorted by a publisher and have no recourse for it."

Voyer also recommended negotiating as part of that clause that if a particularly high shortfall is present, giving $10,000 as the example, that the publisher must also pay for the audit itself.

Pricing

Finally, Voyer suggested that developers not focus too hard on pricing negotiations, as pricing controls are heavily regulated in different countries, making it hard to require a minimum price. Instead, he suggested developers focus on minimum dates for discounts.

"You should set the earliest date by which the game can be discounted," Voyer said. "What you don't want to have happen is have a publisher who's in a bad financial situation discount your game early and decrease the market perception of your game. Because once you discount the first time, you're starting that downward trend on the game revenue side of things."

He added that this can also be applied for bundles, letting developers set the earlier date their game can be included in a game bundle.