Where does the GAME customer go if the High Street closes?

Buying habits of GAME consumer revealed in latest data

While the future of UK specialist retailer GAME is uncertain, many in the retail community across Europe are beginning to ask where customers will migrate if the chain reduces its presence - or disappears entirely - from the High Street.

Data from analyst firm NPD suggests what many might expect - the average GAME consumer is more likely to shop online than anywhere else, with Amazon singled out as one of the most popular retailers for regular GAME customers.

"We were in Europe talking to folks and given some of the publicity that has been out about the struggles of GAME the retailer, we were asked, if GAME goes away, where do we think that consumer will go?" said Anita Frazier, analyst at NPD.

"We looked at GAME consumers and asked where else do they buy software? In fact the GAME consumer was very much more likely to shop at dot.com websites than other consumers of other retailers," she added.

GAME consumers also shop at HMV - another retailer with highly publicised difficulties - and GameStation, itself part of the GAME Group, which only leaves supermarket Asda as the other retailer favoured by GAME customers, according to NPD.

GAME is in talks to sell its overseas business as it survives hand-to-mouth, having difficulties with its lending syndicate and expectations of an £18 million loss for the full year.

Major publishers are concerned about the group, with Electronic Arts highlighting the poor financial condition of the company and possible "bad debt and lost sales," should it continue to struggle.

The UK and France are the biggest markets for second hand games, and without GAME's presence on the High Street, those consumers who buy used games are most likely to increase spending on eBay, where the variety is wider than at HMV or limited Asda stores.

"Our data shows that in the UK and France there's a higher incidence of used game acquisition and we really saw this evidenced in the space that was devoted at retail as well," noted Frazier.

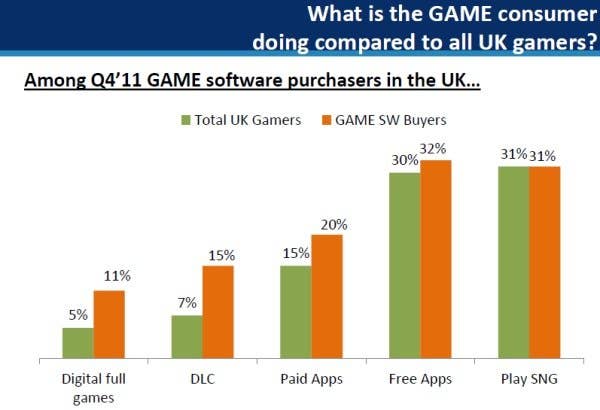

Looking at the wider buying habits of GAME consumers (orange column), they are much more heavily engaged with digital full game downloads and downloadable market compared to the overall UK consumers (green column).

Those GAME consumers are also more likely to buy paid-for apps in the mobile space, and just as likely to engage in free apps and social networking games as the average UK video game consumer.

All data supplied by the NPD Group .