Stock Ticker: State of the Industry

Hunting for the E3 uptick and assessing an industry in a valuation slump

Every year, the games business gets together in Los Angeles for a week in late spring to lay out its plans for the rest of the year - holding a five-day flurry of press conferences, announcements and demonstrations of new products attended by media and retail from around the world, and increasingly also watched online by dedicated consumers who access the show through streaming video sites. For the traditional, "core" games market, this is undoubtedly the centrepiece of the calendar - and it usually does garner plenty of headlines outside the specialist press as well.

To what extent, though, does the spectacle of E3 actually have an impact on the stock markets? It's not quite as daft a question as it may sound at first. The reality for a publicly listed company is that their senior executives have one objective which takes precedence over all others - satisfying the stock market and creating "shareholder value", or in plain English, making sure that investors get a return for their money. One of the great lies of modern capitalism is the claim from almost every company that they're "customer-focused". In truth, the moment a company makes a public offering on the stock exchange, people who buy products and services from it take a distant second place behind people who have bought shares. Sometimes, especially when a company is growing its market, the interests of those two groups align neatly - at other times, especially when the market is shrinking and new ways to build revenue from existing consumers must be found, their interests are radically and even damagingly different.

"No matter what a company announces or demonstrates, the most senior staff will have had one very specific audience in mind - the stock market"

As such, the reality is that no matter what a company announces or demonstrates, the most senior staff will have had one very specific audience in mind - the stock market. Even when showing off a new core game to journalists and hardcore gamers, or announcing new hardware for the delectation of retailers and mainstream press, a company is always keeping one eye on the investors. As such, it's not unreasonable to ask - how did they do? Did E3 move the needle, one way or another? Or did the stock market share the gaming world's general assessment of E3 this year, as a slightly disappointing stopgap show before the real fireworks begin in 2013?

There's also another reason for taking a wide view of the games industry right now. As our recent coverage of stock performance woes at Zynga [ZNGA] and Electronic Arts [ERTS] noted, there's a broad perception that the whole games industry is in decline right now. Sales of boxed software has fallen significantly and none of the predicted recovery points (such as Christmas 2011) have actually reversed the decline. On the other side of the balance, digital sales are still tough to track, so the only really trustworthy data available to investors is the data showing physical sales falling through the floor - and the digital transition is still unknown territory on the whole, with a rapidly changing environment in which winners and losers are tough to predict. Given that background, it's worth taking a look at the last three months of figures and seeing which stocks the market is deeply wary of - and which companies, if any, still look healthy in spite of the turmoil.

A quick note of caution, before we proceed. When I started writing coverage of the stock market on GamesIndustry International last year, I added a few caveats which bear repeating. These features are designed to explore how the markets view specific stocks within our industry, and why they hold that view. They're not designed to provide any great wisdom about the actual state of affairs within the companies involved. It's important not to be in awe of the stock market - it is not an oracle passing down prophetic declarations on the financial future, nor is it possessed of extraordinary insight beyond the ken of mortal man. It's a crowd of fallible, regularly avaricious, sometimes deeply arrogant and often very, very scared people moving money around in pursuit of profits - and like any crowd which has scared people in it, it's prone to panic, to stampedes and to utterly illogical and stupid mob behaviour. If you happen to be a strong believer in the magic of markets and the "wisdom of crowds", that's fine - the White Queen also believed in six impossible things before breakfast, and it never seemed to do her any harm - but that's not the perspective from which these articles are written. A declining share price can indicate underlying problems at a company, but it's only one possible symptom; without examining and understanding the firm's financial performance, its product portfolio, its strategy and its governance, the stock market's assessment of the company (which can take into account some, all or none of those things) is not a useful metric in and of itself.

With that being said, let's proceed to a look at how the maddening crowd has been assessing the games business over the past few months.

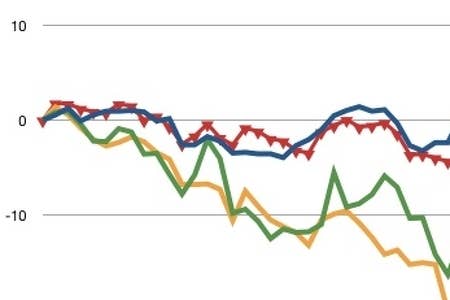

This is as good a place to start as any - with the top three listed publishers in the United States, and the relevant stock market index, the NASDAQ. Missing from this chart is THQ, for the simple reason that its shares are basically junk at this stage - extremely low priced penny stocks which fluctuate widely based on relatively small movements of money. Including it on a graph next to publishers whose share movements still actually represent large-scale financial transactions would be pointless, because the scales are so different - the entire market capitalisation of THQ (the value of all the shares issued in the company) is about $40 million, but you could write $40 million off the value of Activision Blizzard and not even register the movement on a graph at this scale.

What do we learn from this graph? Mostly the same thing that we learned from last week's coverage of Electronic Arts - that EA is in decline (which has continued since last November), that Take Two is in an even steeper decline (although that only began back in March), and that of the three, only Activision Blizzard is managing to track close to the NASDAQ, suggesting that investors are neutral on its prospects. The reasons for that haven't changed since last week, and for a little more insight into that, I suggest that you read the Stock Ticker: Electronic Arts feature if you haven't done so already.

"The appearance of GTA V will undoubtedly help to restore some positive sentiment around the company, but the markets see Take Two as a company that's not really prepared for the changes facing the industry"

With regard to the impact of E3, it's clear that none of these three companies did anything to particularly stir the hearts and wallets of investors. Note the spike on the graph for all three companies around the start of June - to be precise, that spike is on June 6th, at the start of the E3 show. It drops off quickly, though, and has no lasting impact on any of the listings. The message is simple - investors were aware of E3 (naturally enough), a small amount of anticipation buoyed the stocks for a couple of days, but nothing at the show altered the underlying sentiment regarding these companies. A bit of a damp squib, then, although at least none of them started falling faster than before after their E3 showings.

With regard to Take Two, its situation on this graph isn't too hard to understand. Unlike EA, which has actually done very well financially in recent years (hence having to look at more sentiment-based factors around Riccitiello's leadership of the company for root causes of the decline), Take Two's most recent results were disappointing for investors, seemingly confirming that the company is deeply vulnerable to the present transition away from boxed software. That concern is understandable. Activision Blizzard has the most successful subscription MMO in the world and has demonstrated willingness to try out new digital revenue ideas like Call of Duty Elite and the real-money auction house in Diablo 3; Electronic Arts has a digital strategy encompassing distribution, MMOs, social and mobile gaming and various other revenue streams, even if the failure of Star Wars: The Old Republic is calling the execution of that strategy into question. Take Two, by comparison, is still putting games in boxes and putting them on shelves - an approach which endears it greatly to vocal core gamers, but which makes the markets nervous. The appearance of GTA V will undoubtedly help to restore some positive sentiment around the company, but the markets see Take Two, right now, as a company that's not really prepared for the changes facing the industry.

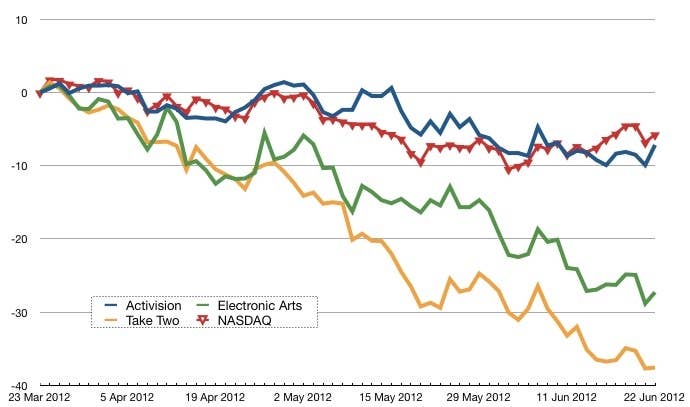

On the other hand, it's not all rosy over in the digital future, either. Several people asked why I didn't include Zynga in the graphs on last week's Electronic Arts feature. The real answer is that I didn't feel that it was comparing like with like; a glance at the next graph might suggest that I was simply averse to viciously kicking a dead horse.

There's a really interesting contrast in this graph, which encapsulates a lot of the sentiment around videogames stocks right now. Zynga, a recently launched stock with a huge amount of hype behind it, is underperforming even the weakest of the traditional game publisher stocks by a significant margin. Again, the reasons have been explored in some depth in an earlier feature on the site, but in summary - the company's rooted to the Facebook era, and there's little sign that it knows how to make the essential transition to being a "mobile-first" business. It's been panic-buying successful mobile firms - most recently paying a ludicrous premium for Draw Something - but shows little evidence of knowing how to generate a bone fide mobile hit. The markets aren't impressed, and execs at EA and Take Two can point cheerfully at Zynga's stock listing and note how much worse things could be.

"The real driver of sentiment for Glu stock is that it's in the right market - making mobile content at a time when expertise in that field is like gold dust"

Check out the top of the graph, however, where Glu Mobile's stock listing is actually the best-performing US videogame stock of the past three months - and the only stock on this graph to end the (admittedly somewhat arbitrary) period on the right side of the 0% line. Glu's underlying performance is solid, but the real driver of sentiment for the stock is simply the fact that it's in the right market - making mobile content at a time when expertise in that field is like gold dust, as Zynga could no doubt tell you with a hint of bitterness. For reference, if we were to extend this chart back to January 1st, 2012, you'd see that with the NASDAQ trading up 10% for the year so far, Zynga and EA are both down around 40% so far this year; Take Two has lost about 28% of its value; Activision is down slightly, losing about 4% of its value... And Glu Mobile? They've gained more than 55% since the start of the year, completely reversing share price losses made during a tough 2011. One to watch.

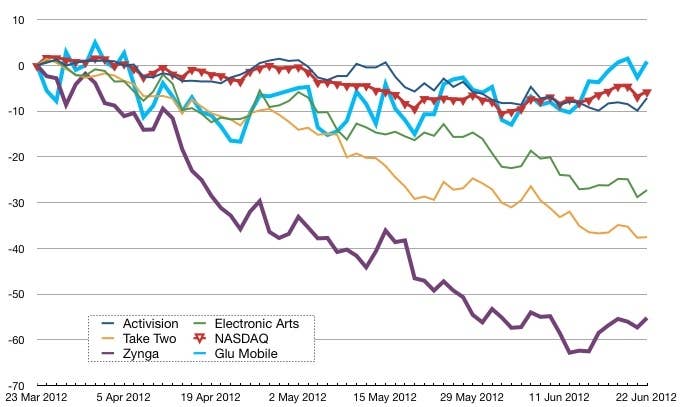

Before we turn our attention away from the western companies and have a look at their eastern counterparts, there are two companies it's worth considering individually. First of all, the west's sole platform holder (unless we're counting Apple, and the situation around Apple's stock is so complex that we'd probably be here all day, so we're not counting Apple).

Microsoft's performance is best described as steady. The company doesn't underperform the NASDAQ, and it doesn't outperform the NASDAQ. That's hardly surprising. For all that Apple is by far the bigger company and Google by far the faster growing company, there's still no firm that quite encapsulates the US tech market like Microsoft does. It's got a huge corporate business, a gigantic revenue stream from operating systems and office software which is as good a way as any to take the temperature of traditional PC system sales, a money pit of an online business and a successful but not terribly profitable consumer devices business in the form of the Xbox (and soon, the company's iPad rival, Surface). It's quite a cross section of tech, and it's unsurprising that Microsoft's stock performance looks similar to the performance of the tech index overall.

"It's quite a cross section of tech, and it's unsurprising that Microsoft's stock performance looks similar to the performance of the tech index overall"

On the other hand, one might note - it's a little bit of a stretch - that both Microsoft and the NASDAQ have seen a few quick gains on this chart, notably around the week of E3 (which saw the announcement of Xbox SmartGlass as well as various other partnerships for the console) and in the following weeks, which saw anticipation building around the press conference that turned out to be the launch of Surface.

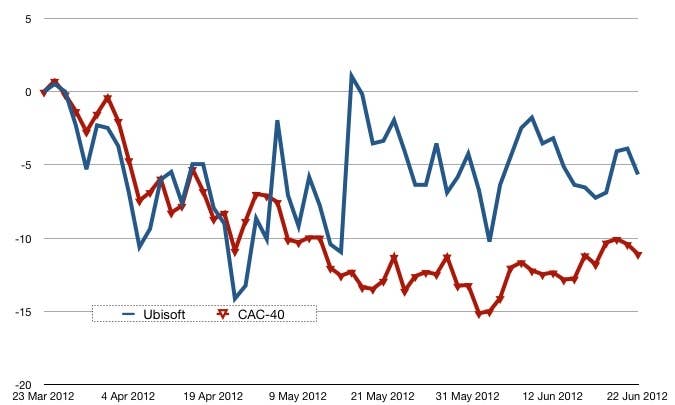

The other western company worth considering on its own is Ubisoft, whose listing on the Paris stock exchange has meant that it's been exposed to buffeting from the present Eurozone woes, and therefore can't really be compared side by side with its US rivals.

As usual, I've compared Ubisoft to the CAC-40 - the index tracking France's largest 40 companies, which provides a reasonable (although somewhat tame, as you can see from the surprisingly smooth curve) assessment of overall market sentiment in the French market. Note that although Ubisoft is down overall during this three month period, the company is actually outperforming the CAC-40 by around 5% - significantly better than the margin by which Activision Blizzard is outperforming the NASDAQ, for reference. A few spikes of note - the large appreciations in value in mid-May are down to the announcement of better than expected financial results and projections. There's also a pre-E3 surge for the company, followed by a gentle drop off after the show. That's not unusual - markets usually boost prices on speculation and anticipation, then slow down once something becomes a reality. The fact that Ubi's stock is higher in the weeks after E3 than in the weeks before is probably partially down to overall sentiment in the Eurozone, but may also reflect investor satisfaction with the company's product slate as demonstrated in Los Angeles.

That's pretty much it in terms of western companies - but of course, the lion's share of the industry's publicly listed companies are not actually listed in New York or Paris, but in Tokyo. I'm going to rattle through these quite quickly (we'll hopefully return for a more comprehensive look at Asian stocks in the near future), since the evidence for an "E3 bump" in most of them is even more flimsy than in the western stocks.

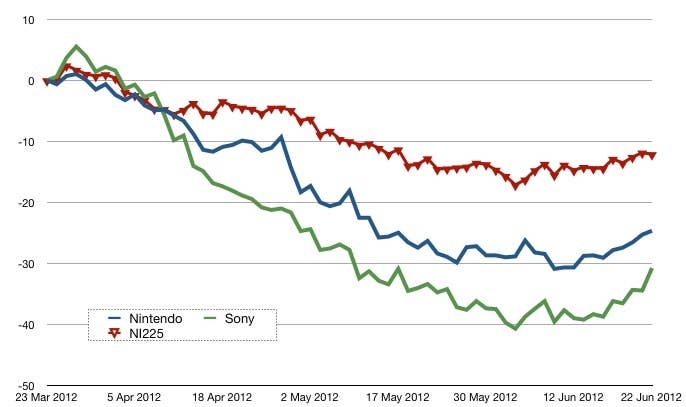

First up, here are Japan's two platform holders. Note that both of them are broadly following the trends of the Nikkei 225 index of Japanese shares, but underperforming it significantly, with Sony the weaker of the pair - Kaz Hirai has yet to convince investors that his vision for Sony's future is credible. Nintendo meanwhile has had a rough few months on the market, after making solid gains in the first few months of the year. 3DS has bedded in as a fairly solid success for the company and the market panic of mid-2011 is long over, but investors are wary on the Wii U and still waiting to see if 3DS' success can be continued to match the original DS.

"Investors are wary on the Wii U and still waiting to see if 3DS' success can be continued to match the original DS"

In terms of E3 "bump" for either company, there's an interesting shape on the graph just there at the start of June. Nintendo's bump comes earlier on, as anticipation for the show was building - its stock peaks on June 5th, then drops off sharply, suggesting that the firm's press conference showing did little to woo investors. Sony's graph, on the other hand, is a bit more positive - sentiment about the company grows firmly from the 4th through to the 7th, before dropping off a little at the end of E3. These are minor fluctuations, of course (and that's really the take-home message from all of this - E3 doesn't create huge turns in stock market graphs), but it's interesting to note that investors clearly liked the tone of Sony's conference (or at least, the second-hand reaction to it) more than they liked Nintendo's.

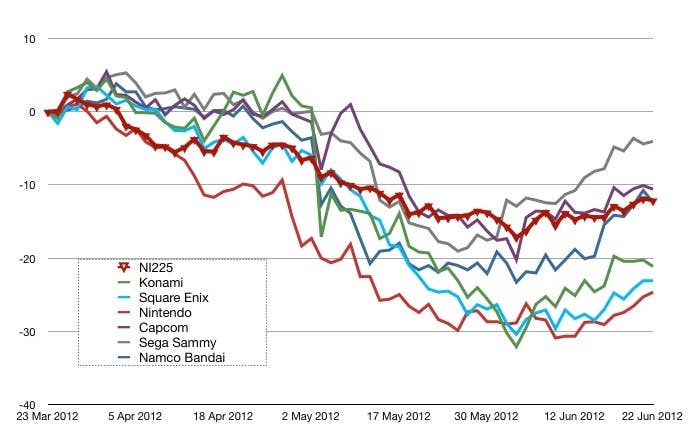

Here's a wider picture of publishing in Japan. The sheer number of successful, publicly listed publishers on the Tokyo market continues to be in sharp contrast with the US picture, let alone Europe's solitary holdout.

Honestly, it's tough to claim any kind of "E3 bump" in that graph. There was a pronounced uptick for each of the US publishers on the same day, but the Japanese publishers are all over the place - following the same broad trend, obviously, but moving in very different directions on a day to day basis.

In terms of that broad trend, it's important not to read too much into a short three-month graph like this one, but do note that Nintendo continues to underperform all of the third-party publishers on the graph. Each of those publishers, notably, has a "non-traditional" strategy of some description - harnessing mobile or social games alongside their traditional businesses. Nintendo does not, and it's hard to escape the conclusion that the markets are a bit nervous over that factor.

"Nexon is the best-performing video game stock in Japan for the past three months, outperforming the Nikkei by almost 10%"

Note also that the only companies outperforming the Nikkei 225 index are Sega Sammy (which has strong interests outside of videogames as one of Japan's leading operators of pachinko parlours, and as such often sees its valuation fluctuate due to factors far outside the videogame space, such as land values) and Capcom. Capcom is actually the smallest company on this graph, but it's also arguably the most "pure" videogames company, with few interests outside its core business. It's heartening to note that although it's fluctuated strongly in one way or another at times, the company's performance since the financial crash of late 2008 has actually been in line with the Nikkei 225, and it's actually been ahead of the market for most of the past 12 months.

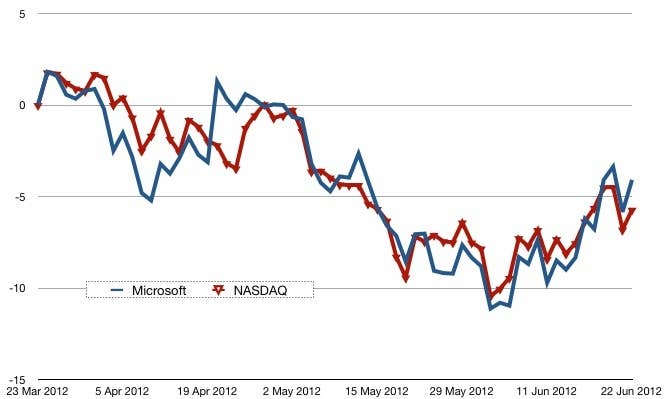

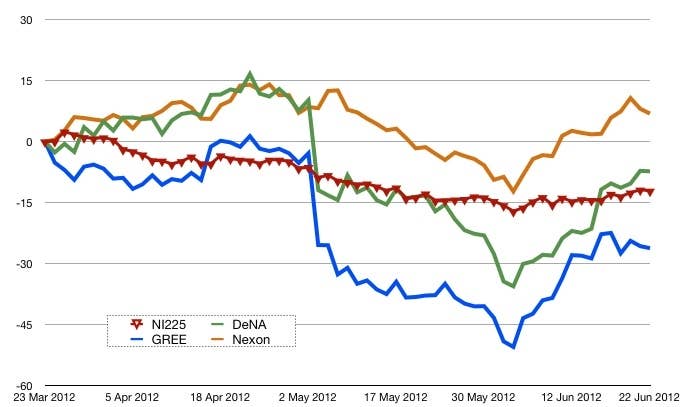

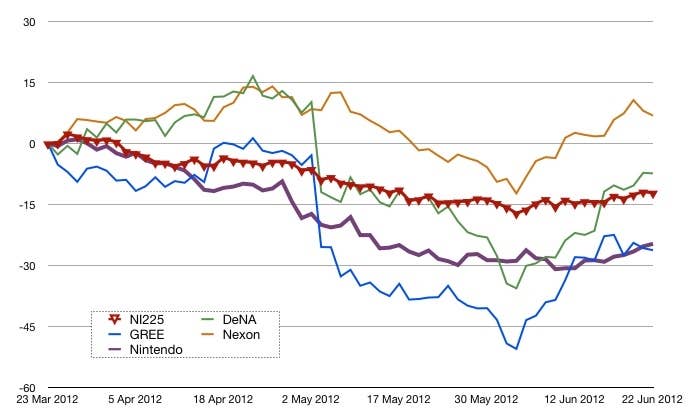

There's another class of company in Japan it's worth examining - the company's rapidly growing mobile and social gaming giants, DeNA, GREE and Nexon, all of whom are increasingly making their presence felt in the western market as well.

Although there's a significant growth in their share prices since early June, the likelihood is that none of these firms have been touched by E3 - but this graph does show how they were impacted by the Japanese government's crackdown on the "complete gacha" free-to-play mechanic a couple of months ago, which was judged to be rather too close to gambling to be permissible (Japan has strong anti-gambling laws, something which has had interesting consequences for the structure of the video games industry many times in the past). In spite of the immediate fall in valuation caused by that ban, both GREE and DeNA are recovering - DeNA, notably, is now outperforming the Nikkei 225 once again, and I wouldn't be surprised to see GREE cross that line in the coming weeks and months as well.

The orange line at the top of the graph is Nexon, a South Korean firm which has based itself in Tokyo and listed itself on the Nikkei exchange. You may recall that it was recently attached to a (deeply unlikely) bid to buy Electronic Arts. Here's a sample of why that kind of story might go around - Nexon is the best-performing video game stock in Japan for the past three months, outperforming the Nikkei by almost 10%. Actually, for the year to date, Nexon is up around 33% (the Nikkei 225 is flat for the year, at just under 0%). With the company seemingly planning fairly aggressive growth in the west in the future, it's likely to be an increasingly important part of the games landscape - it's already the biggest non-hardware games company in Japan by quite a margin, being 50% more valuable than either Sega Sammy or GREE.

On that note, there's a final chart it's worth taking a quick look at.

As you can see, this is a copy of the previous chart, but with Nintendo's line included. This is the clash of the old versus the new - Nintendo's resolutely hardware focused closed platform strategy stacked up against three companies which have embraced mobile, social and free-to-play concepts. Even in spite of the ban on complete gacha, Nintendo doesn't look terribly healthy in this company - it's marginally outperforming GREE, but the trends suggest that won't last. While the success of the 3DS thus far has proved that those claiming dedicated handheld hardware is an anachronism in this day and age are a bit hasty in their assessment, if not entirely incorrect, Nintendo still has a lot to prove if it's going to convince investors that it's a better prospect than young, aggressive firms like these three.