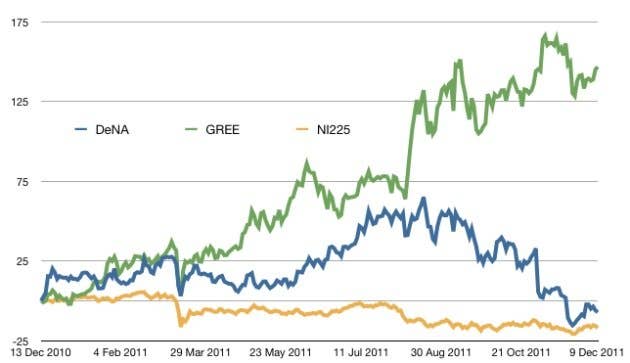

Stock Ticker: DeNA vs Gree

Tracking the performance and prospects for Japan's mobile gaming giants

Attempting to dig through the figures from both companies to establish which of them is actually operating the more popular service is a fruitless task. Both can certainly boast usership figures in 20 to 30 million range, and given the obfuscation of the actual figures, it seems likely that the crown for being Japan's biggest social gaming service (and perhaps by extension its biggest social networking service) passes between them. What's important, though, isn't that absolute figure. Rather, it's what's happening to the revenues of the companies - and what the markets make of their future prospects. From the graphs above, it's pretty clear that Gree's growth is seen as rather more assured than DeNA's. But why?

Context is vital, so here's a useful graph - the yellow line on the bottom is the performance of the Nikkei 225, the index of Japan's most valuable companies. It's not been an easy year for Japanese industry, which has never fully recovered from the Great Touhoku Earthquake in early March (the dip is clearly visible on the graph even on this scale), and has suffered from a one-two punch of fiscal and political instability on top of a vastly overvalued currency ever since then. In the face of that, it's important to note that DeNA is doing fairly well - the past few months have been rough, but it's consistently outperformed the market this year, despite starting this 12 month sample in a fairly strong position already.

Gree, however, is doing marvellously. The big bump for Gree, obviously, comes in August - shortly after the firm announced solid results, plans for a dividend payment (always a boost to share price) and, perhaps most importantly, a tie-up with SK Telecom, South Korea's leading mobile network. That deal underlined Gree's strategy, and perhaps gave some much needed context to the OpenFeint acquisition back in April - an acquisition which many commentators (myself included) have been apt to question or to put down to a quick "me too!" overseas acquisition in the wake of DeNA's ngmoco deal.

The markets, perhaps wary of Japanese companies whose growth plans rely too heavily on the unsteady domestic economy, don't seem impressed with DeNA

Gree is very, very focused on international growth, and that's been very clear throughout 2011. On top of its tie-up with SK Telecom, it's also deeply involved with Tencent, a major player in the Chinese market, and then there's OpenFeint itself - a mobile social gaming platform which enjoys a leading position on Android and has even maintained something of a lead on iOS despite the launch of Apple's own integrated service, GameCenter. It's not entirely clear how OpenFeint is going to move forward, or how Gree is going to integrate it into its business, but what is clear is that the potential exists for the acquisition to give the company a leg-up both in the western market and in the domestic smartphone market.

DeNA, on the other hand, seems to be peculiarly inward-focused in its near-term ambitions. Certainly, the company's ngmoco acquisition gives it a developer with a good track record in the western smartphone market, but a single developer doesn't make a platform. Mobage on smartphone is making headway in Japan, but it's barely made any impact internationally yet - not helped by only having an Android version so far, and thus losing out on the cross-platform potential with iOS which OpenFeint can exploit.

Instead, DeNA's big move this year - developer signings aside - has been the acquisition of a baseball team, the Yokohama Baystars. Something of a bottom-feeder in the series of late, the Baystars (who are now the DeNA Yokohama Baystars) are seen as a way for DeNA to build its profile in the potential growth market of the 30+ age bracket. It's a strategy that may well work, especially if investment can boost the team's fortunes, but while baseball may effectively be Japan's national sport, Japanese baseball has no overseas resonance - it's an entirely locally-focused strategy. The markets, perhaps wary of Japanese companies whose growth plans rely too heavily on the unsteady domestic economy, don't seem impressed.