Stock Ticker: 2013 in Review

Game stocks (mostly) outperformed the markets as enthusiasm for the new spilled over into valuations. But who were the big winners and losers?

- Major US and Euro publishers outperform the markets, as new console launches stir enthusiasm.

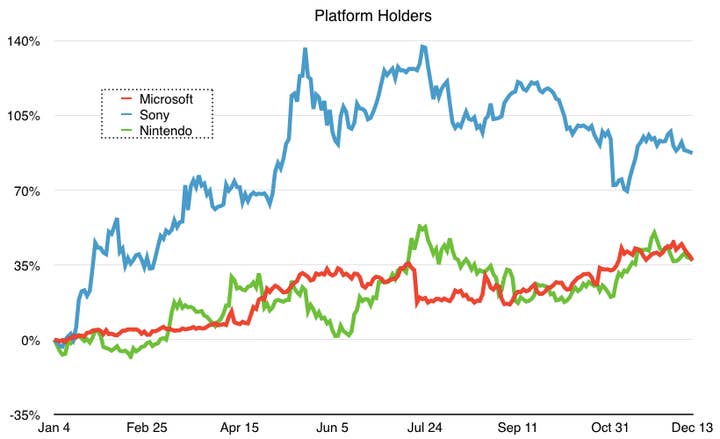

- Sony is top performer among platform holders; Nintendo and Microsoft shares hold steady.

- A tough year for Japanese mobile publishers, as international expansion falters.

It's been an exciting year for the global games business. New platforms, demographics and business models have come into their own, an array of superb games have delighted both the core and the casual audiences, and it's all been capped off with the record-breaking launches of new console hardware. We may still harbour plenty of disagreements over the shape of things to come, but enthusiasm for the coming years is certainly high throughout the industry.

Enthusiasm is the lifeblood of the stock market, so it stands to reason that when the industry is excited about the future, stock prices should follow suit. Stock movements are tempered slightly by reality, of course - a company's actual results do factor into the judgements of traders - but they are primarily a reflection of how likely people think it is that a firm will enjoy more success in future, and that's a notion driven as much by enthusiasm as by any logical calculation.

I've written similar caveats at the top of Stock Ticker articles before, but it's worth repeating - the stock market is not magical or wise. It does not ingeniously discover hidden facts or point out unerring truths. All it discovers is prices - a mashed-up and not necessarily rational amalgamation of the subjective judgements of a large group of traders acting with very different motivations and very different levels of information and understanding. Even so, stock market data is useful, and does give us some broad trend indicators - it's worth knowing, but requires a pinch of salt with every serving.

Let's start our tour of 2013's stock market winners and losers with the platform holders.

Did you see that one coming? Back at the start of the year, I doubt anyone would have placed a bet on Sony being the best-performing of the three major platform holders - but the firm's share price has actually been a much stronger performer than either Nintendo or Microsoft over the year. It's worth noting that it's also been a lot more volatile - between the much-discussed proposal that Sony should split up its business (ultimately and probably rightly rejected by the company's board, although they conspicuously failed to put forward an alternative plan for dealing with the firm's loss-making divisions) and the torrid performance of Sony Pictures' summer releases, it's been a bumpy ride for Sony this year. The trend is upwards, though, and that's at least partially down to the PlayStation division. It's no accident that the biggest spike in valuation this year came in May, when positive public reaction to the PS4 buoyed Sony to its highest point in two years.

"Sony's share price has actually been a much stronger performer than either Nintendo or Microsoft over the year"

It's worth, however, taking a slightly closer look at these figures. They're all positive - every platform holder showed share price growth - but they need to be considered in the context of the wider stock market in each country. The real test of a stock price isn't whether it gained or lost value (although of course losing value is a bad thing in general), but whether it outperformed the market as a whole. If a stock gained 20% but the market overall leapt 50%, it means you've effectively lost money by investing in that stock rather than taking the wider "basket" of stocks represented by an index tracker - and effectively translates to a pretty low estimation of that stock on the part of traders.

This year, both the NASDAQ (in the USA) and the Nikkei 225 (in Japan) grew reasonably strongly - with the Nikkei in particular being lifted by a weakening Yen and cautiously positive business sentiment around the so-called "Abenomics" stimulus and reform package proposed by Japanese prime minister Shinzo Abe. A rising market lifts all boats; what we'd really like to see is whether our particular stocks are floating higher in the water than everyone else.

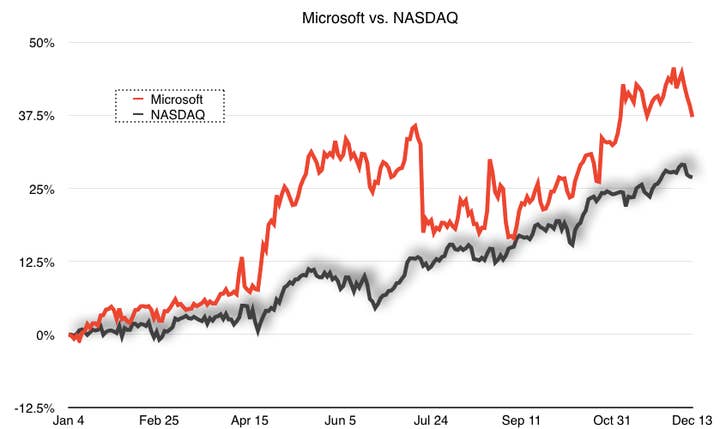

Here's how Microsoft looks over the year, compared to the NASDAQ. It's not breakthrough performance but it's respectable nonetheless. A rally in April came to an abrupt end in July, but the stock still outperformed the market by the end of the year. Unlike Sony, for whom the PlayStation business is a significant part of the company overall, I'm wary of attributing much of Microsoft's stock price movement to the Xbox business. Xbox may be high profile, but the real driver of Microsoft's stock price remains tied up in operating systems and office software. Moreover, the actual performance of the Xbox division is extremely opaque - the console business is wrapped up in a broader business division which includes a number of other products, and it's been claimed this year that the company is funnelling its huge profits from licensing charges on Android phone handsets through this business division, effectively masking any fluctuations in revenue or profit from the Xbox under the muffling weight of billions of dollars of unrelated revenue. In short, nobody's trading Microsoft on the basis of Xbox figures alone - nobody sane, at least.

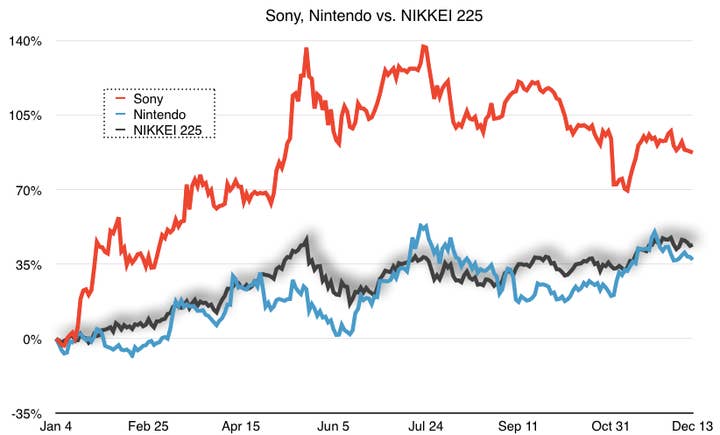

Here's the picture from the other side of the Pacific. Sony's success over the year is clear when compared to the NIKKEI 225 index - the company has impressively outperformed the index for the entirety of 2013. This isn't to say that Sony is out of the woods in terms of its financial and organisational problems, but a good stock performance effectively insulates the board of the company (including CEO Kaz Hirai) from the demands of pushy overseas shareholders.

"Nobody's trading Microsoft on the basis of Xbox figures alone - nobody sane, at least"

Nintendo, meanwhile, has very closely matched the NIKKEI's progress over the course of the year. Its shares are a long way from the record highs reached during the halcyon days of the Wii, but it would be wrong to interpret that as a signal of Nintendo's failure - those record highs were outright daft, valuing a successful but volatile game company, albeit briefly, ahead of all of Japan's enormous industrial giants, including Toyota, the world's largest car company. This year has shown a stock market that's largely neutral on Nintendo. It makes sense - the 3DS is doing extremely well but the Wii U had a dismal time, with green shoots of recovery only starting to appear in the twilight of the year. My instinct is that the markets don't think WiiU will make its target figures for the year and have built in an expectation of disappointment in their pricing - look for Nintendo shares to get a significant boost early next year if WiiU actually shows evidence of approaching its ambitious targets.

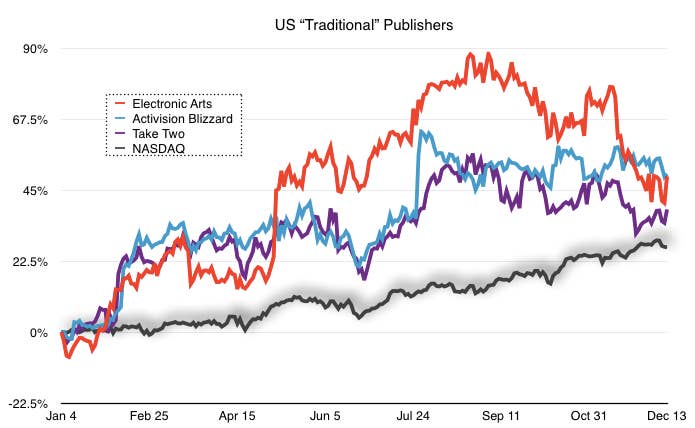

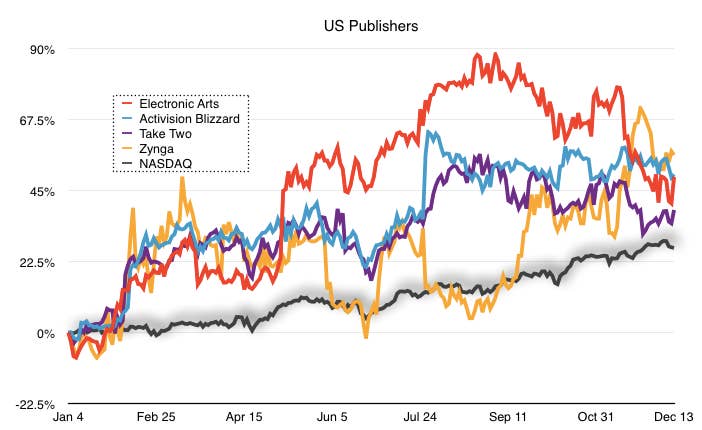

Moving away from hardware, let's take a look at third-party publishers. First up, the United States:

Again, the black line here is the market index - the NASDAQ, in this case. The take-away is pretty clear - US publishers have had a pretty good year. NASDAQ growth has been solid but unspectacular, while the three major listed publishers have all outperformed that level, with EA and Activision both ending the year up around 50% on last year's close. Incidentally, Zenimax is a privately held company - it would be interesting to see how its valuation compared to the other publishers at this point, were it public.

"GTA V, despite its enormous sales and rapturous response, made almost no difference to Take-Two's share price"

It's notable that EA's share price is rather more volatile than the other two publishers. In some cases this is down to being traded at a lower price point (these graphs use percentages, and a cheaper stock will naturally have higher percentage swings in value) but EA's share price is actually higher than either of its rivals, so that can't explain the volatility. Some of it is probably down to the changes at the top of the company - John Riccitiello left in March, and was eventually permanently replaced by Andrew Wilson in September, so the price swings in the intervening months may have been influenced by anticipation of changes resulting from a new CEO.

It's also worth noting that GTA V, despite its enormous sales and rapturous response, made almost no difference to Take Two's share price - and Call of Duty Ghosts also didn't make much difference to Activision Blizzard, perhaps even precipitating a small drop off in the firm's valuation in early November. This is a reflection of how the markets work. GTA V was always expected to perform incredibly well, and performing within expectations is neutral to valuation. Ghosts was also expected to do very well, and did so - but perhaps not as well as had been hoped, resulting in a small drop in valuation despite strong sales.

There is one other US stock it's worth taking a look at, which I didn't include in the above graph for the sake of clarity.

Zynga has had an extremely volatile year - ending the year up significantly (actually, it's finishing the year with stronger growth than the traditional publishers, on paper) but also dipping below the market line on a number of occasions. This is down to the phenomenon mentioned above - Zynga's valuation is still in the bin after it tumbled sharply last year, and small changes in actual value can result in large percentage swings on the comparative graphs. Basically, Zynga's year hasn't been bad, perhaps even suggesting that the markets anticipate some recovery, but it's still a long way below its original IPO value. If you invested in Zynga when it floated, you're still very much out of pocket - if you invested in it at the start of this year, though, you might be happy enough with the year's performance.

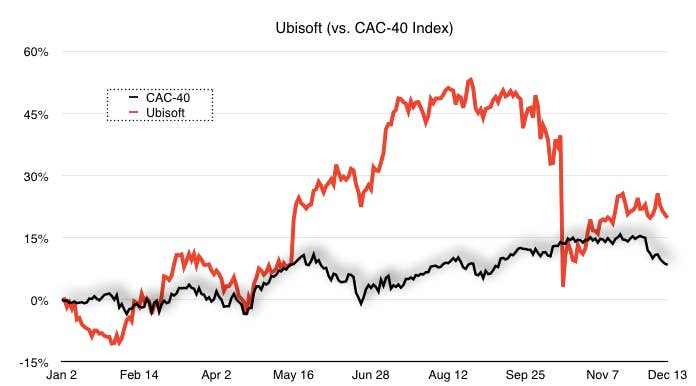

Crossing the Atlantic to Europe, there's only one publicly listed publisher worth graphing - France's Ubisoft, with the CAC-40 index of French shares for comparison.

This is one case where anyone familiar with the year's gaming news can probably look at the graph and figure out what's happened rather easily. The rapid rise in value kicks off in May, when Ubisoft wowed crowds at E3 with arguably the most impressive line-up of games of any publisher at the show. The huge drop in October is the flip-side of the coin - the company delayed a number of titles, including the enormously anticipated Watch_Dogs, and the share price fell off a cliff. All the same, Ubisoft's portfolio of titles remains strong and its delayed titles are some of the hottest prospects of 2014, so it's already made back much of the valuation lost following that announcement.

"Ubisoft's portfolio remains strong and its delayed titles are some of the hottest prospects of 2014, so it's already made back much of the valuation lost"

Transposing graphs from one region to another is a dodgy business given the very different underlying market conditions involved (I know I did it with the platform holder graph at the beginning of this article, but I feel that comparison is at least somewhat justified). However, we can glance between Ubisoft's graph and the US publishers and see that the French company is somewhat comparable - it's grown slower overall, but outperformed its native market by a similar level to a firm like Take-Two.

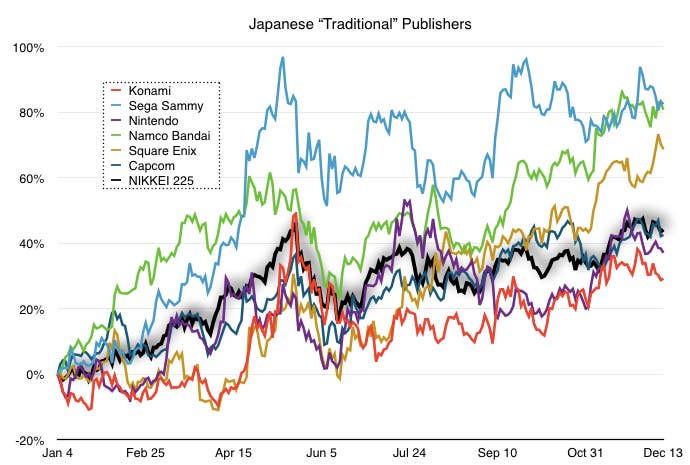

Spinning the globe again, let's take a look at a very messy graph - the Japanese publishers.

Japan has a lot of publishers on the Tokyo Stock Exchange, so this graph is a bit tough to read - and for the sake of clarity, I've only included the "traditional" publishers who primarily target console platforms, saving the mobile and F2P publishers for the next graph instead.

At a glance, it's a mess, but we can quickly see that there are two significant groups here. At the top of the graph, Sega Sammy and Namco Bandai have had very solid years, growing their share prices over 80%. How much of this is directly attributable to games is questionable. Both firms are doing okay in the games business, but both of them have significant outside interests, including large property holdings and, especially in Sega's case, a huge presence in the "it's not gambling, honest!" pachinko parlour business (which is very much gambling, but skirts around the edges of Japan's anti-gambling laws by keeping the awarding of prize money at arms length from the main business). Part of Sega's strong valuation may be down to the anticipation that the Japanese government may soon legislate to provide companies with permits to open up real casinos, allowing the firm to diversify away from pachinko.

"Sega Sammy and Namco Bandai have had very solid years, growing their share prices over 80%"

At the other end of the graph we see a big cluster of firms around the heavy black line, which is the NIKKEI 225 index. Nintendo and Capcom have tracked the index closely all year, indicating market neutrality about their stocks. Konami has undershot the index by a significant margin, but still tracked it closely enough to be considered in this latter group (and again, the firm's external interests, including a huge chain of gyms and health centres around the country, may be a bigger factor than the games business itself). Square Enix, meanwhile, straddles a kind of middle ground. The first six months of the year saw it follow a trajectory similar to Konami, under performing the NIKKEI significantly; the second half has been much better, with the firm ending the year strongly in the black. Strong positive sentiment around the relaunch of Final Fantasy XIV as well as good performance for new Dragon Quest titles in Japan and a much-anticipated forward slate with new Final Fantasy and Kingdom Hearts games may account for much of that growth - the overall sense is that Square Enix is coming out of a very tough few years, with overseas operations also looking better than previously, though the growth remains fragile.

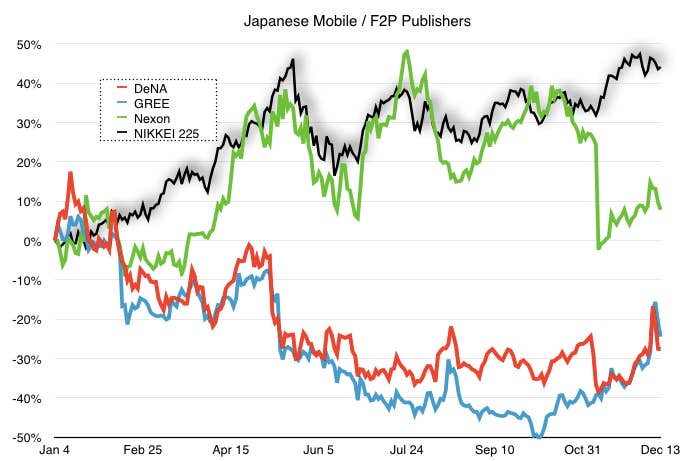

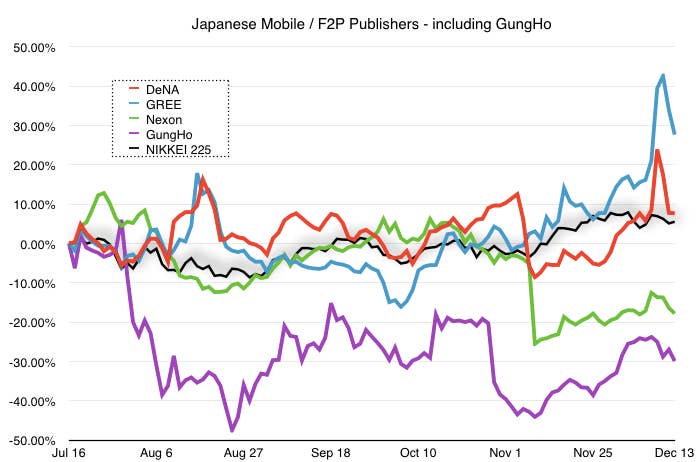

Turning our attention to the mobile market, we see a dramatic reversal of last year's fortunes.

DeNA and Gree remain extremely important players in Japan, but this year they've been overshadowed by a variety of problems. In their home market, the biggest phenomena of the year have been Puzzle & Dragons and Clash of Clans - both now associated with newcomer GungHo (more on them in a moment), while the resurgent Nintendo 3DS has also eaten into enthusiasm about the mobile market somewhat. A bigger problem, perhaps, is that neither company has impressed investors with the progress of their overseas expansion ambitions - and even more worryingly, there's a sense that in trying to create a gaming "platform" rather than simply being successful publishers, both companies may have taken entirely the wrong approach to smartphone gaming. This is especially an issue in Japan itself, where the iPhone is extraordinarily dominant in the smartphone market - and not terribly friendly to the notion of a non-native "platform" for games. Both Gree and DeNA need to prove themselves in 2014 by launching games which successfully compete both domestically and internationally rather than concerning themselves with their platform technologies.

"In trying to create a gaming platform rather than being successful publishers, Gree and DeNA may have taken the wrong approach"

Doing rather better is Nexon, which is included here for convenience but is actually a bit of an outlier. For one thing, it's a Korean firm that just happens to be listed on the Tokyo Stock Exchange rather than maintaining a Seoul listing. For another thing, it's not primarily a mobile company, but is instead primarily a free-to-play company - being, in fact, one of the progenitors of that entire business model, thanks to its now decade-old title, Crazy Racing Kart Rider. It's currently best-known for the MapleStory games, which have been quiet but very solid performers for several years.

I mentioned that I'd come back to GungHo, and indeed, the firm deserves our attention. It's had a crazy year - Puzzle & Dragons cracked $3 million in daily revenues before even launching internationally, it received an enormous investment from Japanese telecommunications firm Softbank, made an enormous acquisition of Finnish developer SuperCell (of Clash of Clans and Hay Day fame) and, thanks to the merging of the Osaka and Tokyo stock exchanges back in July, found itself listed on the Tokyo Stock Exchange. In fact, at the time of writing GungHo has the highest market capitalisation of any game company in Japan, with the exception of Sony and Nintendo.

However, since the exchanges merged in July, we only have comparable data for GungHo from July onwards - so this final graph, comparing GungHo to the other Japanese mobile players, shows only the second half of the year.

Unexpected, perhaps - GungHo, despite arguably taking much of the wind out of the sails of DeNA and Gree, has actually under-performed both of them in the second half of the year. In fact, the graph suggests that the other mobile companies might be in recovery after a tough time in early 2013 - both Gree and DeNA end the year slightly over performing the NIKKEI, if we calculate values from July onwards.

"GungHo's fall could represents a drop back from overheated insanity to a more rational level of valuation"

GungHo, meanwhile, dropped rapidly from its initial valuation and never quite recovered. This does not, however, necessarily reflect weakness with the company itself - though I suspect traders are wary of its heavy reliance on Puzzle & Dragons, and it's notable that the firm's booth at TGS this year seemed to be overtly designed to convey the message that the company does have other games aside from the all-conquering P&D. Moreover, GungHo's market valuation does remain higher than either of the other firms - and like Nintendo, it could be argued that this fall represents a drop back from overheated insanity to a more rational level of valuation, rather than a loss of market confidence.

So there you have it - 2013 in stock market graphs. The real take-away, if you've made it this far through the text, seems pretty clear - it's been a good year for game stocks. Almost all of the traditional game companies have outperformed their local markets by some margin, with only Japan's mobile firms, somewhat at sea due to under delivering on promises of expansion, showing disappointing results. If the stock market is a measurement of sentiment, then the message here for 2014 seems clear - as long as you view it through the fairground mirror that is stock market data, next year is going to be a very good year.