Stock Ticker: 2011 In Review

Format holders, publishers, retailers - who won and lost on the global stock markets last year?

For now, though, let's turn our eyes to the United States, and more specifically at the publishing sector. In terms of US-listed publishers, there are four major players that it's worth looking at - Activision, Electronic Arts, Take-Two and THQ. Here's their graph for 2011.

This graph shows very clearly the separation that's happening in the games business - something that's been an ongoing process for a few years, but which has come to a head in 2011 and will continue to have a major impact in 2012. Publishers that haven't achieved a certain scale just can't compete in the market right now - if you don't want to get completely squeezed out, you either get very big, or you find a niche market where you don't compete with the big boys.

THQ is a perfect example of a mid-range publisher that has failed to take either of those paths, and this year it was brutally punished by the stock market for that failure. THQ still thinks it's a big publisher. It still wants to play the AAA game, and to its credit, it does know how to turn out solid AAA console titles - but it hasn't got the scale or the resources of its larger rivals, and as costs and risks in the console space spiral, I'd argue that the window of opportunity for a company like THQ to grow up to heavyweight size has closed. That, more than any transient event, is why they're down nearly 90 per cent in valuation over 2011.

For all the talk about Bobby Kotick's abrasive attitudes being a play to the stock market, the reality is that the market isn't exactly impressed with the direction in which he's taking Activision

But look at the top of that graph. It's extremely telling that, of the big three US publishers, Activision Blizzard, the largest, is the only one to undershoot the NASDAQ. Take-Two showed moderate growth, while EA did really rather well. I've talked about this before, but this drives it home - for all the talk about Bobby Kotick's abrasive attitudes being a play to the stock market rather than to gamers, the reality is that the market isn't exactly impressed with the direction in which he's taking Activision either. It's not that the company is doing badly, but World of Warcraft is stagnant and Call of Duty, although still huge, isn't about to hit a growth spurt either. The markets want growth, and right now, nobody (least of all Kotick, I suspect) can see where Activision's growth is going to come from. Does anyone really see them creating a compelling original IP in the coming year or two?

By contrast, Take-Two has done a solid job of convincing people that it's still got the chops to create very valuable new IP, and to exploit it in a careful way that doesn't lose or alienate consumers. EA has done an even better job, and convinced people that it has an intelligent mobile, social and online strategy into the bag - although shareholders will be very anxious to see what happens to Star Wars: The Old Republic now that it's finally on the market. If it turns out to be a solid revenue generator, expect EA to soar in 2012 - if it hits the rocks and has to be rethought as a freemium game sooner rather than later, the markets will start to question the strategy that John Riccitiello has spent the past half-decade implementing for EA's revival.

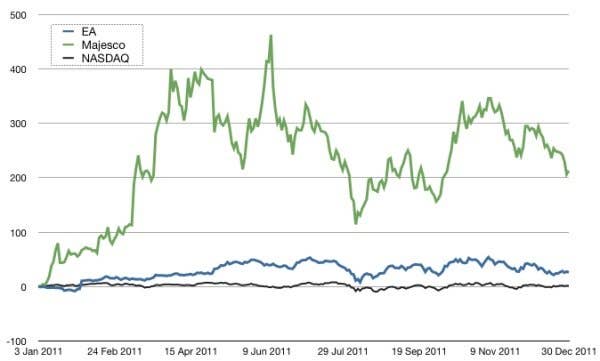

Speaking of revivals, though, it's worth having a look at one last stock before we leave the US publishers. EA may be the best performing of the big publishers, but who's this plucky smaller firm soaring above the giants?

That's right - if you wanted to make serious money on a videogame stock last year, your chips should have been on Majesco, which ended 2011 more than 200per cent up on its opening price for the year. It's a small capital stock, so it's prone to much more aggressive movements than the large, expensive stocks - compare its rollercoaster ride to the placid movements of EA's stock in the above graph - but that's still impressive growth. Why? Well, investors seem to quite like the fact that the company has combined a low cost base with a keen eye for niche titles that can become breakout hits, like the Cooking Mama series. It will be interesting to follow the company's trajectory in 2012 and see how much room to expand there is in that formula.

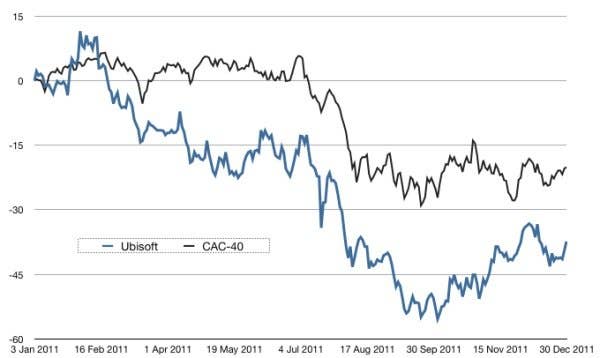

We'll turn away from publishers in just a second, but first, let's look across the Atlantic at Europe's sole remaining global publisher of note. With Eidos now swallowed up by Square Enix, only Ubisoft's stock on the Paris exchange is really worth analysis. Unfortunately, it isn't useful to compare Ubisoft with any of the US publishers, because the Paris exchange itself has been buffeted by uncertain financial winds in the past year. Instead, I've stacked Ubisoft up against the CAC-40 index of French shares, which has unsurprisingly had a torrid year in the face of Eurozone doom and gloom.

Ubisoft, too, has had a weak year. I'll take a closer look at Ubisoft at some point in the near future, but for now it's worth noting that the company has underperformed the CAC-40, but not in any particularly unsurprising way. For the most part, Ubi's decline is the same pattern as the CAC, just steeper, and I'd suggest that's more reflective of deeply worried French investors pulling out of uncertain, risky tech stocks in favour of 'safer', more traditional investments than it is of a fundamental weakness at Ubisoft.