Navigating the storm: Lessons learned from the mobile market's downturn

My.Games Venture Capital executive director Nikita Matsokin breaks down the numbers to see what's been working (and what hasn't) in the mobile market

For quite a while the gaming market was considered by some to be an evergreen industry that thrives regardless of the worldwide economic situation.

And it's no wonder such beliefs were common, as the videogames market has been growing for the last 30 years, performing relatively well even during the tough 2007-2008 crisis. In 2020, not the best time for many sectors, the revenues of video game companies increased by 23.1% (Newzoo).

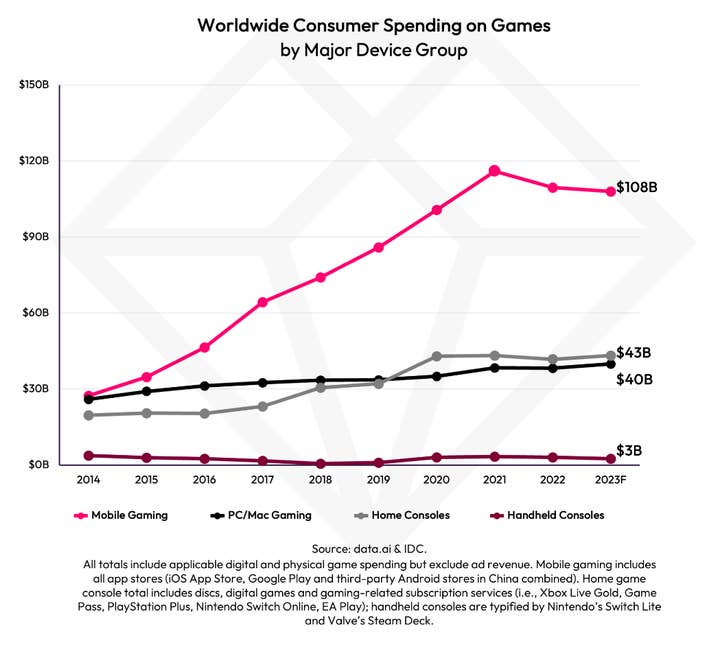

However, everything changed when 2022 hit the world. According to data.ai, the size of the video game industry in 2022 amounted to $193 billion, a 5% decrease from the 2021 figures. Another "novelty" was that the leader of the fall was the mobile games segment which comprised more than half of the overall gaming industry and declined by almost 7%.

In comparison, the decrease in the console games revenue was 3.4%, while that of the PC games was just 1%. But what could possibly go wrong in a market that has been blossoming for more than a decade and that was not (or at least not dramatically) impacted by significant economic declines? Let's dive into the details.

What happened to the mobile games market in 2022

For the last decade, the mobile sector has been a key driver of the video game industry's growth. However, as I've already mentioned, 2022 puts a pause on the mobile gaming industry's previous rapid expansion. Here are some of the factors that affected the market's decline in 2022:

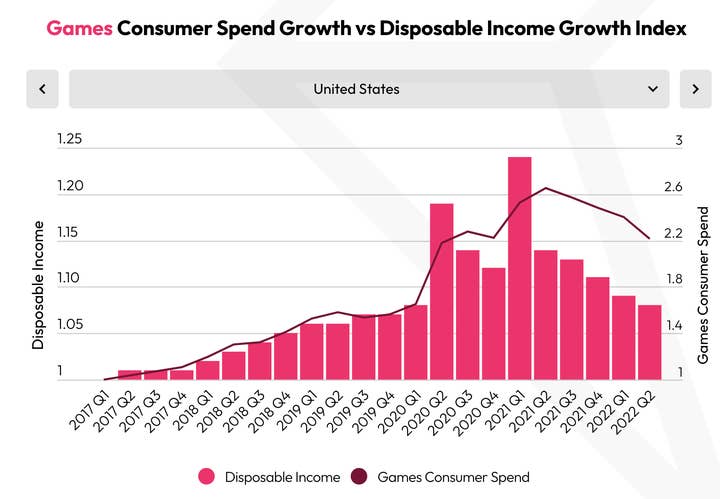

- Change in players' payment behaviour that might be associated with a decrease in disposable income. On the graph from data.ai, we can observe that disposable income and consumer spending in games in the USA behave very similarly and a drop in the former starting from Q2'2021 is aligned with a decrease in the latter. This likely affected return on investment models of mobile publishers, making them more conservative and targeting shorter timelines for seeing a return on their investment.

- Growing competition for players' attention with short video services and streaming services. The choice for the mobile audience is not only which game to play, but also whether to play or to spend time in other apps. And their choice often seems to fall on short video services that in 2022 accounted for 17% of all mobile time spent. One of the most popular ones is TikTok, which surpassed one billion MAU (monthly average users) in September 2021. It's worth mentioning that streaming services as a whole are a significant competitor, being the No. 1 category of non-gaming apps by downloads and revenue in 2022 (according to data.ai).

- A long-term effect of Apple's IDFA depreciation. Currently, only 45% of iOS customers opt for tracking which results in an associated change in the way publishers manage User Acquisition, as older higher-spending cohorts that consist of well-targeted players were replaced with less-targeted and less monetized ones.

- Increased competition within genres resulted in the game quality bar and the cost of user acquisition rising significantly, making it extremely complicated for new games to break through.

These issues have affected not only small and medium-sized studios but also large players who find it increasingly difficult to launch new games in the changed market environment. From the headlines, we know that EA cancelled mobile Apex Legends and Battlefield games and Playtika suspended its new game launches until the marketing landscape improves.

Even large players have found it increasingly difficult to launch new games in the changed market environment

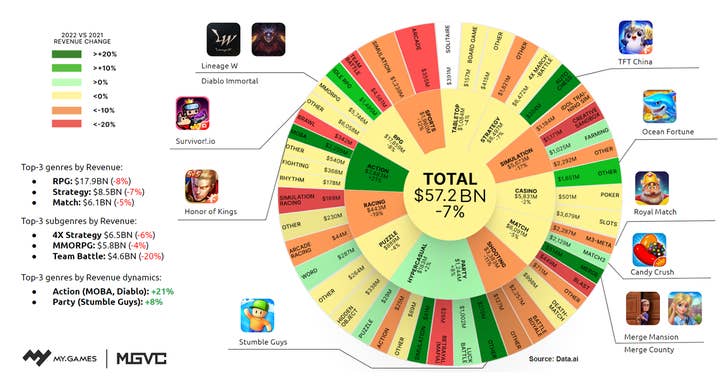

Now that we've discussed the preconditions, let's consider the consequences (the data) in more detail. We've analyzed the evolution of mobile market trends on a subgenre basis by creating custom models based on data.ai featuring the changes in the key genres and subgenres according to data.ai taxonomy year by year.

Disclaimer: Please note that all the data we provide regarding the market size, the size of the genres, and the size of specific regions is based on our model (if not stated otherwise). In the model, we rely on the data.ai taxonomy. The revenues of markets, genres, subgenres, and specific titles were obtained from data.ai. data.ai always works on improving its data, which is why the numbers we show in this article might be different from the numbers currently shown by data.ai (as, unfortunately, we cannot constantly update this text). Also, note that we only consider the revenue generated by paid downloads and/or in-app revenue net of 30% platform commission that goes to the iOS and Google Play stores. We do not account for revenue generated outside the app stores, such as advertising and e-commerce. Keep in mind that ad revenue also plays an important role in the overall size of the gaming market and the size of each of the regions/genres.

Now that you've read the disclaimer and know that the picture below in no way covers the whole market size (ads-driven monetization is missed, at least), let me note that we still can make some useful conclusions and get the idea of how the market was behaving in 2022.

So what's this circle about? On each petal, the size of the genre/subgenre in 2022 is represented as well as the difference in size compared to 2021. The petals are also coloured based on the direction and the volume of the change in the size of a genre/subgenre. Some of the key revenue-generating titles in the genres are highlighted in the picture below.

Well, you might have heard that the global mobile gaming market dropped by 7% in 2022, but let's break that down a bit.

RPG, Strategy, and Match genres that were the leaders by revenue (and together comprised more than half of the market) all decreased by more than 5%. The drop in the RPG sector was mainly caused by the poor performance of the Team Battles subgenre, the revenue of which dropped by 20%.

Even though the Strategy genre itself did not perform so well, it is significant to highlight the Auto Chess subgenre that increased by more than 20% with TFT China being the key revenue driver. The Merge subgenre (which is a part of the Match genre in our analysis) also posted growth of more than 20%, with Merge Mansion and Merge County being among the leaders.

Even though the overall industry environment was pessimistic, some genres managed to show good results

Even though the overall industry environment was pessimistic, some genres managed to show good results. The revenue of Action games increased by 21% thanks to the strengthening of the MOBAs. One of the key revenue drivers there was Honor of Kings. The Party genre also increased, though less significantly (by 8%). An honorable mention in the genre is, of course, goes to the Stumble Guys game.

Now that we have a clearer picture of what was going on in different genres, it's time to talk about regions.

Western markets (Tier-1: USA, Germany, France, Great Britain, etc.) accounted for $25 billion in revenue and comprised 44% of the global industry. With a 12% drop in 2022, the Western region was one of the key drivers of the global mobile gaming industry decline. Top-3 genres in the region by revenue volume were Match ($4.7 billion), Strategy ($4.5 billion), and Casino ($4.1 billion) which decreased by 5%, 12%, and 10% respectively. RPG revenue also declined by 12%, while Party was the only genre that had positive dynamics showing an 8% growth.

In Asia (not including China), the situation was similar - the mobile gaming market dropped by 10% getting down to $16.9 billion. Unlike the worldwide trend, in Asia, the Party games' revenue decreased by 37%, although the Party games segment is very small in this region with only $96m in in-app revenue in 2022. In general, all the genres faced a decline apart from Casino ($707m) and Action ($619m) games, which increased by 13% and 7% respectively.

The emerging markets (i.e. South America, Turkey, etc.) comprise less than 5% of the global mobile gaming market with $2.7 billion of in-app revenue in 2022, though mobile gaming in these regions had much more positive dynamics. The mobile gaming industry in emerging markets increased by 5% in 2022 with most of the genres supporting this growth. The growth leaders in these regions were Party ($137m) and Match ($225m) games that increased by 50% and 16% respectively. However, not all genres were flourishing in emerging markets in 2022. The revenue of RPG ($553m), Sports ($108m), and Racing ($21m) games decreased by 6%, 2%, and 12% respectively.

Last but not least, it's important to highlight that China is a huge part of the worldwide mobile gaming market. On iOS, the in-app revenue of mobile games in China in 2022 was $10.8 billion, which is a 19% increase compared to 2021. However, as we do not have the data on the Android performance in this region, a detailed analysis would not be meaningful, as Android stores play a significant role in this region.

Okay, that was lots of data, but it was essential to dive into the figures to get the whole picture. But what's going on in 2023? (Attention: a bit more data is arriving).

According to the results of the first half of 2023, we can say that the market has reached a plateau. In its latest report, Newzoo predicts the mobile gaming market to rise by 0.8% in 2023, which is not a lot, but an increase after all.

However, according to our model that is based on the data.ai data (don't forget about the disclaimer while looking at the figures), the results of the first half of 2023 show that the market has decreased by 1% compared to the first half of 2022 and is currently estimated to be $28.7 billion (once again, it's a figure for half a year).

Party games continue growing, showing more than a 60% increase compared to the first half of 2022

Party games continue growing, showing more than a 60% increase compared to the first half of 2022, with Eggy Party and Monopoly Go being among the key growth drivers. By the way, Monopoly Go deserves an honorable mention, as this fresh release has gained strong positions on the Luck Battle market that has been historically dominated by the Coin Master. It even managed to outperform Coin Master (what seemed to be nearly impossible for quite a while) in terms of in-app revenue in August 2023, according to data.ai.

Match games recovered from a drop in 2022 and have earned $3.5 billion in the first half of 2023, even exceeding the figures of the first half of 2021 mainly due to the outstanding performance of the Gardenscapes, Royal Match, and the Candy Crash titles.

Despite the positive dynamics of the Party and Match genres, the continuing decline in the revenue of RPG, Shooting, and Strategy games (they decreased by 3%, 22%, and 13% respectively) prevents the mobile gaming market from getting back on its growing track. However, there are some very interesting releases in 2023 in these genres that are worth mentioning. One of them is, of course, Honkai: Star Rail from the Genshin Impact developer MiHoYo. The game was released in April 2023 and shows impressive performance on mobile (which is not that much of a surprise, to be honest). Another promising release is White Out Survival, a survival strategy game that made its way to the top-20 strategy games by in-app revenue in H1 2023 according to data.ai.

Reasons for investment share decline in the gaming industry

Now let's take a look at the investment environment in the games industry based on the data from InvestGame.

Prior to the outbreak of COVID-19, the number of transactions and the volume of investments in the gaming industry was set at a certain level. Everything changed with the onset of the pandemic — many industries had to tighten up. As a result, investors – including institutional ones – drew their attention to games. This brought a large amount of investment into the gaming industry from venture investors, strategic holdings, and so on.

The "feast" lasted until mid-2022, after which the Western markets slowed down. As a result, investors became much more careful and conservative. We see that in Q3 and Q4 of last year, the volume of investments significantly dropped along with a decrease in the volume of transactions. Q1 and Q2 of 2023 have also been on a downfall, however, the results of Q3 are about to be significantly different probably not by the number of deals, but definitely by their size, as Savvy Games Group closed its acquisition of Scopely for $4.9 billion in July and the acquisition of Rovio by Sega for approximately $775 million closed in mid- August.

As a result, we can conclude that investors are still active, but they are now much more cautious. They have significantly raised their expectations regarding the companies and projects in which they are ready to invest.

Now let me elaborate a bit more on the reasons behind the drop in the volume of the late-stage and M&A (mergers and acquisitions) transactions at the beginning of 2023. Late-stage means investments in already established businesses, when there is a new spark for their growth, and M&A is when the ownership of the entity is transferred to or consolidated with another company.

The volume of late-stage transactions has decreased because investors find it more complicated to further monetize their investments in a turbulent market. Considering M&A, shareholders of companies that have seen high valuations in a hot market are not ready to sell their shares at much lower prices.

As a result, there are fewer strategic investors and less buyers' activity, because everyone is careful with their money, and can no longer participate in the bull run for higher multipliers and valuations. Now buyers are more inclined to deeply dissect the targets and really understand the underlying synergies and benefits for the business that comes as a result of the M&A. However, the examples of Scopely and Rovio deals give hope that the videogames M&A market is about to revive and to return if not to the activity levels of 2020-2021, but to the pre-pandemic figures.

To sum up, 2022 has opened a new chapter in the history of the mobile gaming industry. Indeed, it brought its difficulties, and many teams, both small and big ones, had to reconsider their strategies and future plans. However, these unsettling times have also opened lots of opportunities. There are many talented developers all over the world, and I believe that we all, as the mobile gaming industry, will learn the lessons of the past year and will find new ways to create even better games.

Just don't forget the basics: the foundation of a successful product is always a fun gameplay and an exciting gaming experience that make players return to your game.