Money Games: Online, Mobile, China and More

Digi-Capital's Tim Merel on the fundamental shifts in games investment for 2011

China, Not America, Could Dominate the Global Games Market

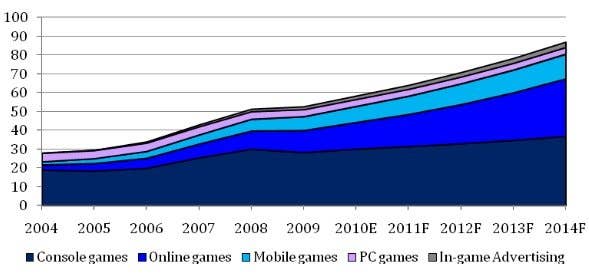

We now believe that China, not America, could dominate the global games market. Online/mobile games should grow total videogames market size to $87 billion and take 50 per cent revenue share at $44 billion (18 per cent compound annual growth rate for fiscal 2009-2014), with the historically strong pure console sector flat to down.

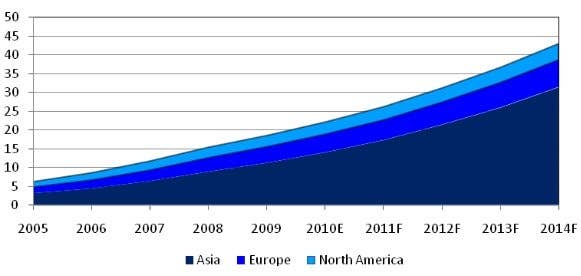

Asia Pacific and Europe should take 90 per cent revenue share for online/mobile games (China 49 per cent, Europe 17 per cent, Japan 14 per cent, South Korea 11 per cent in 2014), although North America remains important.

China's domestic strength has produced high volume (companies like Tencent deliver up to 20 million peak concurrent users – a population the size of Australia at one time), low Average Revenue per User, cost efficient online/mobile games businesses with up to 50 per cent operating margins, enabling significant investment in foreign markets.

Global Video Games Sector Revenue ($ billion)

Regional Online/Mobile Games Revenue ($ billion)

Speaking at the Shanghai World Expo and GDC China last year, and interviewed by CCTV this year, I was struck by the single-minded focus and drive of the Chinese games companies I met. Their approach is analytically driven and commercially balanced, they understand how to make substantial profits while growing revenue at scale, and they are hungry for more.

The high volumes possible in the Chinese domestic market are something which foreign companies can only dream about, and given the relatively high volume/low ARPU nature of online/mobile games, it is an advantage to be respected.

Almost every Chinese games company I know is looking for two types of investment: Foreign companies they can use as a business platform to leverage their domestic strength internationally; and foreign intellectual property and knowledge they can leverage in their domestic market.

At the banquet in honour of China's Vice Premier Li Keqiang (tipped by some to be the next Premier) in London in January, I was fascinated when he voiced sentiments that I heard many times last year. Chinese companies are excellent at execution, but they would like to move further ahead in global terms when it comes to innovation.

Similarly, the 12th five-year plan provides a stronger drive and support for Chinese games companies to increasingly globalise. So we expect to see Chinese companies as major games consolidators in 2011, investing in, acquiring, partnering and licensing from the strongest international online/mobile games companies. The Tencent/Riot Games acquisition announced in February (estimated at $350-400 million) is a portent of more to come.

Online/mobile independents should invest for growth or exit in 2011

In the current market, we believe online/mobile independents should invest for growth or exit in 2011.

Online/mobile games are high growth, but unconsolidated (2009 $19 billion revenue = 32 per cent of global videogames revenue, 2014F $44 billion revenue = 50 per cent of global videogames revenue), with more than 200 million casual online unique users, more than 700 million social online monthly active users, more than 20 million MMO subscribers and more than 10 billion iPhone apps (55 per cent of which are games) downloaded.

Barriers to entry remain low (outside of Facebook social games), with strong competition but limited market dominance by major competitors. Independents are competing successfully with more established competitors, with high revenue growth (100 per cent-plus) and operating margins (50 per cent-plus) being delivered by the strongest independents.

Videogames investment and M&A are accelerating, with fundraising 52 per cent higher in 2010 than 2009, and M&A 60 per cent higher in 2010 than 2009. Online/mobile games valuations for both investment and M&A have been rising, with major deals attracting significant interest.

Major corporate acquirers are increasingly looking to external investments, acquisitions, joint ventures and strategic partnerships for online/mobile games growth and diversification, and as discussed the strong Asian players (from China, Japan and South Korea) are actively seeking foreign opportunities to leverage their capabilities internationally, as well as to source international IP and knowledge for large domestic markets.

But the opportunity will not last forever, as public companies are subject to intense analyst scrutiny of high valuation investments and acquisitions. Not all current online/mobile games investments and M&A are likely to deliver as expected during 2011, with a potentially negative impact on valuations.

So the time to act is now, either raising funds to accelerate growth prior to consolidation, building joint ventures and strategic partnerships to enter major foreign markets (particularly from and to China, Japan and South Korea), or exiting to take advantage of the strong M&A market and valuations.