Mobile to be "primary hardware" for gaming by 2016

Shifting mobile game market to hit $9 billion in 2016, says Juniper; tablets helping to drive in-app purchases

The mobile market is evolving rapidly, as hardware and operating systems continue to shift worldwide. These trends are increasingly important to the game industry, as the market for mobile games is also growing at a rapid pace. Android is gaining on iOS, Windows is getting a foothold on tablets and smartphones, and market share is changing around the world. Recent reports from various research firms highlight the changes.

Market intelligence firm Juniper Research says in a recent report that smartphones and tablets are going to be primary device for gamers to make in-app purchases in the future. Juniper projects 64.1 billion downloads of game apps to mobile devices in 2017, compared to the 21 billion downloaded in 2012.

According to TechCrunch, Juniper believes mobile hardware "will become the primary screen for gamers." Juniper says that will happen with growing numbers of "sophisticated games, which allow for truly multi-platform gameplay through the use of cloud technology," according to report author Siân Rowlands. The fact that mobile device memory continues to rise is allowing more room for games, too. Juniper notes that handheld videogame consoles like the 3DS are definitely being impacted by the rise in smartphones and tablets, as evidenced by Nintendo's cutting its forecast for 3DS sales by 14 percent.

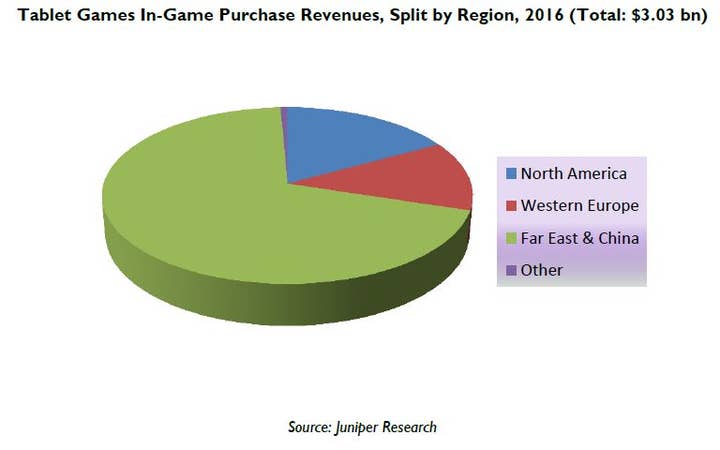

The company sees tablet owners as eager gamers, downloading twice the number of games as smartphone owners. "Tablet games are growing so much because they are such an accessible way for all consumer segments to access games. In particular mid-core gamers, who previously spent a lot of money and time playing games but now have jobs, families or other commitments, are driving this trend," said Rowlands. "These people are really embracing the tablet form factor, and innovative gameplay devices such as the mobile based Ouya console, really appeal to them." Most of the in-app purchase revenue from tablets will be from the Far East & China and North America, and Juniper believes tablets overall will account for 86 percent of in-app spending in 2016.

Juniper projects that tablet gamers will spend over $3 billion on in-app purchases in 2016, which is more than ten times the $301 million Juniper calculated for 2012 tablet game revenue. Still, smartphones continue to outpace tablets, with more than $6 billion projected to be spent on them in 2016. The company's study found a clear migration from portable game consoles to tablets and smartphone. Juniper pointed out that the freemium model is harder to implement on portable consoles, which mostly don't have 3G or 4G connectivity and thus wouldn't have the ability to download new content at nearly any time.

Free-to-play games will dominate the mobile game market even more than today, with Juniper forecasting that only 7 percent of games will be paid for at the point of purchase in 2017. The company also predicts that Social & Casual games will remain the most popular genre at more than half of all games downloaded on mobile.

Meanwhile, vast changes are occurring in the market share of mobile platforms. According to research firm Strategy Analytics, global branded tablet shipments reached 40.6 million units in Q1 2013, up 117 percent from 18.7 million in Q1 2012. Microsoft has made progress in the tablet market, going from zero market share to 7.4 percent after the launch of Surface and other Windows 8 based tablets, with more than 3 million such tablets shipped in Q1 of 2013. Of course, tablets of all kinds were at a record high in Q1, with 40.6 million tablets shipped worldwide, with year-on-year growth of 117 percent. That's impressive growth, but it's still less than the growth from Q1 2011 to Q1 2012, which hit 146 percent.

The Windows 8 tablet may seem to be a minor player in the tablet market, but at least it's outpacing Windows Phone smartphones, which have only grabbed about 3 percent of the worldwide market two years after the initial shipment. Why hasn't Windows Phone made more progress? Strategy Analytics notes that "very limited distribution, a shortage of top tier apps, and confusion in the market, are all holding back shipments." Microsoft has as yet been unable to capitalize on its gaming success with the Xbox, and has failed to get major traction among game developers (despite paying some developers to put apps on Windows Phone).

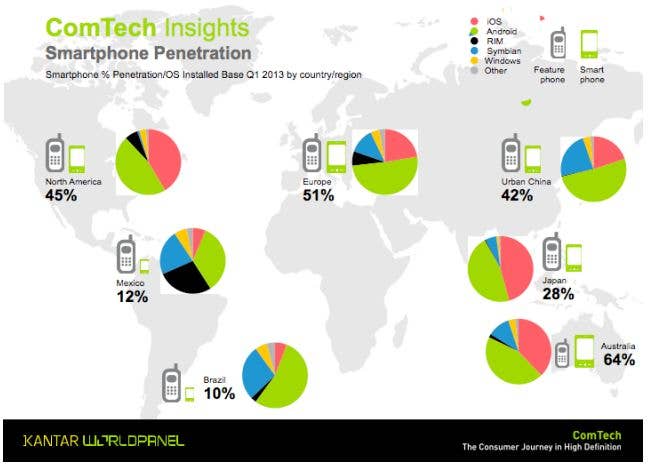

At least, though, Windows Phone has been gaining share in the US market, according to a recent report from Kantar Worldpanel Comtech, rising to 5.6 percent of the US market. Windows Phone's gains worldwide are steady, as Nokia pushes out a bevy of brightly colored, low-priced Windows Phones to countries around the world. The market for those appears to be largely feature phone buyers finally making the switch to a smartphone; 52 percent of Windows Phone buyers in the US are moving to it from a feature phone.

Kantar's study also showed Android leading in sales across the nine markets surveyed in Q1, with 64.2 percent of all handset sales. Japan was the only market where Apple's iOS was in the lead. Everywhere else, Android smartphones are ahead. Once again, though, Apple is fond of pointing out that iOS users spend more money on apps and in apps, which is why game developers still tend to head for iOS first. These market share figures, though, show why game developers don't ignore Android anymore.

Apple's sales of tablets are growing well, as can be seen by the data from Strategy Analytics. But Android is growing much faster, eroding Apple's market share down to 48.2 percent compared to Android's 43.4 percent. Apple shrugs off the raw numbers comparison, pointing out that figures still show that users in the US, at least, overwhelmingly use their iOS tablets to access the Internet and pay for some of the over 350,000 apps that are designed specifically for the tablet.

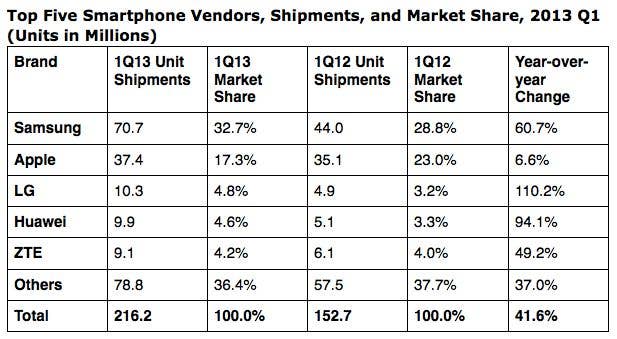

The Android device fragmentation is still an issue; the multiplicity of devices and versions of the Android operating systems are a major headache. Still, Android smartphone sales are increasingly concentrated in a few top vendors; Samsung sold an astounding 70.7 million smartphones in Q1, almost double the 37.4 million smartphones Apple sold, according to a recent IDC report. Perhaps more tellingly, Samsung grew its smartphone sales by 60.7 percent over the previous year, while Apple grew only 6.6 percent. This is why analysts and others speculate that Apple may introduce a lower-cost iPhone; the company is losing ground against Android.

The wealth of data and informed speculation about the future has several clear implications for game developers. Mobile devices are going to continue their strong growth, and will continue to put pressure on other, similarly priced gaming devices. The sheer number of smartphones and tablets in the world, which has already climbed to over a billion devices, makes it an attractive market. Android is growing faster than Apple, and combined with the maturation of the Android market that means it's not a market any mobile game developer can afford to ignore. Microsoft has shown some life in both smartphones and tablets, though not enough growth to come anywhere near iOS or Android.

The challenge for game developers, large and small, continues to be how games get discovered on mobile platforms - and, of course, how to come up with a hit game that will stand out amongst hundreds of thousands of competitors. The only thing we can be sure of is that significant changes in the marketplace will continue.