Lars Wingefors on why Embracer is going away, and what happens next

With the group splitting into three, we speak to the CEO about the future of his companies and what led to this point

When Embracer CEO Lars Wingefors declared an end to the company's nine-month restructuring program at the start of this month, you would have been forgiven for assuming that things would finally settle for the troubled games group.

That assumption was brought into question on Monday when the company announced it would be splitting into three separate entities: Asmodee Group, Coffee Stain & Friends, and Middle-earth Enterprises & Friends (with new official names for the latter two to be revealed at a future date).

GamesIndustry.biz caught up with Wingefors mere hours after the announcement to talk through its implications, the future of the three companies, and why – after the years-long aggressive M&A push that grew the Embracer empire – he has decided to now break it apart.

The CEO tells us the split enables Embracer to "better finance our businesses" and "lower the cost of capital." And shareholders clearly approve, since Bloomberg reports the company's stock rose 18% after the news emerged.

"We would like to create the optimal environment and conditions for our businesses to be successful for us to make the absolute best products and to hire and retain the best people," he says. "And we need to have the optimal structure for those companies to prosper within. We are a public company and the current structure within Embracer Group in the current environment is not optimal.

"To create successful games, and to retain and hire people, the company needs to have that environment, and the environment for Embracer – and similar companies for that matter – has changed a lot. We had a number of years, 2019 and 2020, where the cost of capital was really cheap and the willingness from investors to invest into growth organically and inorganically via M&A was endless. We also had a gaming market booming, especially during COVID, and we had a much more solid geopolitical situation, for example, in Russia. All those factors have changed a lot."

This, he says, is why Embracer announced it was undergoing a 'special review' of its business and the markets in November 2022 – before the collapse of the $2 billion investment deal and the subsequent restructuring program.

"We have been thinking for years about how to adapt to the environment," Wingefors says. "But obviously what happened in 2023 was the situation for the industry, ourselves, and the capital market worsened, and we needed to restructure and to make some significant changes, including divestments for Saber and Gearbox.

"The financial market doesn't like the volatility of AAA games. I don't think AAA games companies should carry a lot of debt, if any"

"Now coming out from this, it was important to me to go, 'okay, let's look into the future. Let's create the optimal environment to create success for my people and the businesses, and start talking to stakeholders –investors, employees, industry – about how we see the future."

The Embracer restructure has been under scrutiny ever since it was announced, with plenty of industry analysts and commentators – including our own Rob Fahey – offering their thoughts on how the company's six-year spending spree on studio acquisitions led to this state of affairs.

When asked for his own perspective on what led to the group's woes, Wingefors repeats the external factors he mentioned earlier: the COVID boom, the increased availability of investment for M&A, the more stable geopolitical situation and so on.

"It's a changed gaming market, a changed appetite from consumers," he says. "The success of the games we released decreased in the past few years because the appetite from consumers or the quality from some titles was not good enough. We needed to focus more and make sure that the investments we're making ultimately have a return.

"At the end of the day, no matter the financial market, the products we create need to find the consumer and they need to be willing to pay for it – and they have a lot of different choices. It's a mixture of that and obviously the cost of capital, which has become much more expensive – and the appetite from investors to put new growth capital completely vanished at, I would say, the end of 2022.

"The fact that we also decided to take on debt for the first time in our history, which is something in hindsight you could be very humble about. Debt always needs to be repaid."

Embracer ended 2023 with a debt of $1.5 billion. The sale of Saber Interactive wiped off $205 million, while the sale of Gearbox will have wiped out more, but the remaining debt is still in excess of €900 million / $963 million.

Alongside the announcement of the split, there was a carefully-worded press release regarding a financial agreement through Asmodee with five major banks to the tune of €900 million, and Wingefors spells this out for us: this is the amount of debt that will move from Embracer to Asmodee. It was the acquisition of Asmodee that put the group into debt in the first place, but Wingefors also suggests the tabletop publisher has the strongest chance of clearing it.

"The banks love Asmodee, they know the company has been highly leveraged on their private equity ownership for more than a decade," he says. "That amount is basically paying down the debt – not all, but most of the debt – in the remaining Embracer Group, meaning Coffee Stain & Friends and Middle-Earth & Friends. Basically, we are in a much better position from a balance sheet perspective today.

He continues: "The financial market doesn't like the volatility of AAA games. I don't think AAA games companies should carry a lot of debt, if any. You could argue that with mobile and recurring revenues, a gaming business could carry some debt, but the capital market doesn't like to provide that debt. So I think you should have a very low, if any, debt within digital gaming over time.

"We have taken a lot of financial risk out from Embracer and improved our balance sheet and stability"

"I'm a firm believer in equity. I think debt in general is quite dangerous as a tool. You should be careful to carry too much in gaming. Board gaming is different, it's a very stable business with very stable cash flows… We have taken a lot of financial risk out from Embracer and improved our balance sheet and stability by doing this."

As for the debt split across the other two companies, Wingefors says the remainder they need to pay off is "not a lot," especially once the considerations from the Saber and Gearbox divestments clear later this year.

The CEO also clarifies something else for us: the Embracer name is going away. As part of Monday's announcement, Wingefors also stated he intends to set up a new holding company that will help him form an "ownership structure that would be a long-term supporting shareholder," enabling him to retain ownership and be a majority shareholder for all three companies. The name of this new company has not been disclosed yet, but he said he is leaving the Embracer name behind.

We ask if this is to distance his next firm from the controversy and backlash around Embracer, especially over the past year, to which he responds: "Not at all. These name changes are strategic decisions aimed at allowing each new entity to develop its own unique brand identity, tailored to its specific business focus and to maximize its potential in the market."

For the time being, Wingefors remains CEO of Embracer Group, which will continue to exist for at least a year until Coffee Stain & Friends breaks away in 2025. The details of the structure of his new holding company and how it will interact with the leadership with each of the three entities will be made clear in time, but for now it sounds like this will be similar to the decentralised approach Embracer Group always took – albeit with a trio of companies rather than a dozen operating groups.

Yesterday, we published Wingefors' response to the criticism he has received regarding his management of the group and a restructure that led to three studio closures and more than 1,400 layoffs. When asked how he plans to do things differently going forward, he emphasised that much of the decision-making will fall to the chiefs of each entity – Thomas Koegler for Asmodee, Anton Westbergh for Coffee Stain, and Phil Rogers for Middle-Earth – as well as the leadership teams they build around themselves (e.g. the CEOs of Plaion, THQ Nordic and other firms that have been split between the three groups).

"I would like the management teams of those businesses to form their own specific strategy in terms of how they operate their business, how they consolidate what games they make, how they monetize, and so on," he said.

"Being public is also a lot about communication, to communicate to stakeholders about what's going on and how the future looks and so on," he says, referring to the fact all three businesses will have their own listing on Nasdaq Stockholm. "When we started back in 2016, there were three people in the headquarters and it's been a journey to communicate the build-up of THQ Nordic first and then later Embracer Group, and today it's an enormous task and our quarterly report is very long and full of information.

" The public markets are very cynical, they only believe in execution. Don't talk too much, just deliver and it will sort itself out"

"The more you disclose and tell, the more questions there are. So the management teams need to be mindful about how they communicate and why they are communicating. Ultimately, I want them to communicate first to gamers, and I don't think the public company setting is the right forum necessarily to communicate to consumers and gamers – or even to employees, even though we have used it to have a common platform to communicate what's going on across the group.

"The trust and value you are creating as a public company is only driven by the execution. The way to communicate is to execute, meaning make great games, earn money, and take the next step. The public markets are very cynical and my learning is they only believe in execution. So what I will say to the new management teams is don't talk too much, just deliver and it will sort itself out."

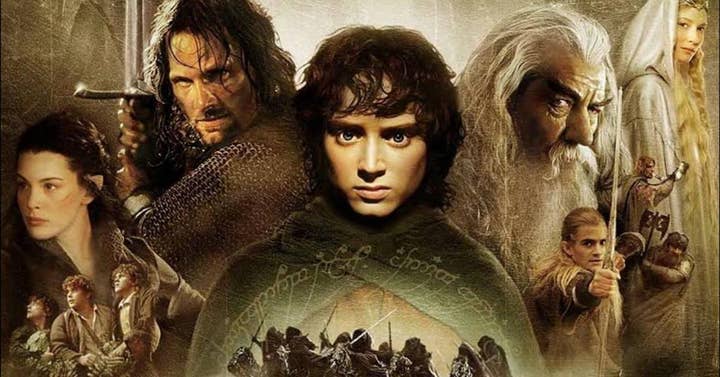

While it makes sense for tabletop publisher Asmodee to be separated from the video games firms, it's interesting to see how the rest have been split between Coffee Stain and Middle-earth. The former encompasses everything from indie to AA, as well as free-to-play, but sees THQ Nordic (the progenitor of Embracer Group) fall under Coffee Stain. The latter is positioned as the AAA games business, but is fronted by Middle-earth, a brand best known for its literary and cinematic output than video games.

Wingefors tells us how the companies were divided was based on various factors, including the cultural fit of which teams have worked well together in the past, as well as the size of the projects – "Doing a game in the single A or AA space is very different from doing an enormous Kingdom Come: Deliverance 2 with 250 people," he observes. "Creating the AAA games or the big games of tomorrow requires a different management structure and toolset than is required within Coffee Stain."

In the case of Coffee Stain, he asserts that the indie publisher has a similar financial profile to Embracer's mobile businesses. "They are very stable, they are growing, they have strong cash flows, high margins. If you combine them, from a financial metric it makes a lot of sense," he explains.

He also assures that Embracer's retro games archive remains a priority, although it's unclear at this stage where it will fall within the legal structure of the three entities that emerge from the group's breakup.

"We [can't] do all the sequels gamers want for all our IPs and the IP we control or own – it's impossible"

Looking at the future of Embracer Group and the three companies that will emerge from it, he says there is "a lot of power to be unleashed within all three groups" – especially within gaming – and talks up the opportunities for transmedia ventures across the 900 IPs spread across the three companies.

"Just the Middle-earth opportunity on its own is just amazing if you think about it – what you can do and how you can expand that world and how you can do that with gaming, but also how you can combine it with other media. I'm a huge believer in transmedia. I'm encouraged to see the success of Fallout on Amazon Prime in recent weeks. It's a fantastic example of how you could do a successful transmedia."

As has always been the case with Embracer, he emphasises that ownership of an IP does not mean the companies have specific plans for them. Instead, he believes Coffee Stain and Middle-earth will be cautious about what they produce in the coming years – potentially leaving TimeSplitters fans, for example, in limbo once more.

"You need to be adaptive," Wingefors explains. "That doesn't mean that we could write any cheque [being] blind to anyone. That doesn't mean that we can do all the sequels gamers want for all our IPs and the IP we control or own – it's impossible. The company, or ultimately the owner, that is not adaptive to the environment will become obsolete."

Wingefors is also quick to reiterate what he has already told investors: it is too early to talk about further M&A deals. As with Embracer, any acquisitions will be handled by each company, with Wingefors predicting that Asmodee is the only one likely to acquire any other businesses, at least to begin with, as and when this strategy resumes.

"The focus right now is to execute, make the games, consolidate, and get the trust back in the capital markets," he says.