Has 2023 been a good year for new games? | This Week in Business

We compare the number of new games on the US Top 10 best-seller charts this year with previous ones and see how the numbers square up with overall industry sales

This Week in Business is our weekly recap column, a collection of stats and quotes from recent stories presented with a dash of opinion (sometimes more than a dash) and intended to shed light on various trends. Check every Friday for a new entry.

The end of the year is coming up over the horizon, and that means it's about time to start reflecting on the year that was.

And it was horrible, right? The pandemic bubble burst in a big way, the layoffs flowed like water, E3 collapsed, and the acquisition-hungry publisher that made such a big deal about preserving gaming's history executed Volition Games and we found out last week it's ready to do the same to another storied studio in Free Radical Design.

But if all you care about is the quality of new games – and to be clear, you should care about more than that – it was also great, right? Zelda! Spider-Man! Starfield! Diablo!

That's the conventional wisdom at least. But one thing we like to do around here is test the conventional wisdom to see how well it holds up. Because while it's often more-or-less accurate, conventional wisdom does tend to gloss over some important details.

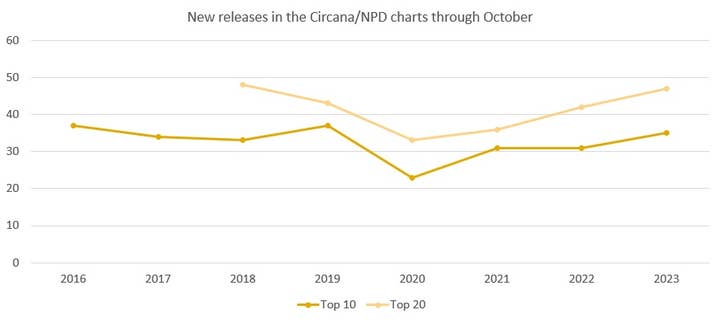

That's why last year, after hearing for months about how terrible 2022 was for new games, we sifted through the US sales charts for a This Week in Business column to see if they would back that idea up. We combed through years of NPD monthly sales charts and added up how many new games had appeared in the Top 10 and Top 20 of those charts up through that point of each year (the October sales report), reasoning that would be a rough indicator of whether publishers had been consistently producing new games to appeal to the market. In essence, was it a good year for new games?

What we found was perhaps a little surprising, in that 2022 was considerably better than the previous two years for new games in the Top 20, and not far behind the pre-pandemic years either.

QUOTE | "This year's line-up of new releases hasn't gotten enough credit. Sure, the industry isn't putting out hit games at its pre-pandemic pace, but it's not far off the mark, and 2022 will finish well above 2021 and 2020 when it comes to new releases in the Top 20. Relative to the rest of the games on offer (which is the thing this exercise can most solidly demonstrate for us), 2022's new games have been roughly as compelling to consumers as those of years past." – My takeaway from last year's column.

In the end, the conventional wisdom about 2022's dire game lineup seemed a little overblown. So how about 2023?

Well, Circana (formerly NPD) released its October US monthly sales consumer spending report this week, giving us the comparable information we need to revisit last year's column and see how 2023 shapes up.

STAT | 32.3 – The average number of new games to make the Top 10 charts in the first ten months of the year from 2016 through 2022.

STAT | 35 – The number of new games to make the Top 10 charts in the first ten months of 2023.

And we're off to a good start. At the very top of the charts, we're doing a little bit above average. In fact, only 2016 and 2019 were better, each of them with 37 new releases hitting the Top 10 through October.

But maybe it's top-heavy? Does the 2023 roster have depth players as well as stars?

STAT | 40.4 – The average number of new games to make the Top 20 charts in the first ten months of the year, from 2018 through 2022.

STAT | 47 – The number of new games to make the Top 20 charts in the first ten months of 2023.

That's actually even more impressive. It's a smaller sample size to work with as the NPD didn't release Top 20s for every month of the year until 2018, but 2023's 47 new releases hitting the Top 20 is still well above average, better than any other year except 2018's peak of 48.

Maybe this is just a matter of some big games being delayed because of the pandemic; we know for sure The Legend of Zelda: Tears of the Kingdom and Starfield were intended for release last year, and other games this year may have been planned for 2022 but never publicly dated.

Regardless, this year's numbers at least show that the flow of top-selling new releases has returned to pre-pandemic levels. All in all, this (admittedly imperfect) measurement lines up fairly well with the conventional wisdom: 2023 has indeed been a very good year for new games.

So how come the actual Circana sales figures don't show the year-over-year growth we might expect from a bumper crop of bangers on the new release front?

STAT | 1% - The year-over-year growth in US consumer spending on games through October.

If the numbers are telling us the industry is producing chart-topping hits at an elevated clip here and the conventional wisdom tells us this is a hit-driven industry, why aren't the sales as impressive as the release slate?

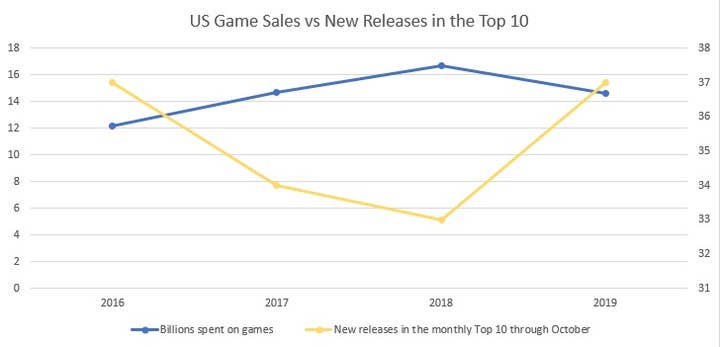

This actually isn't entirely unusual. Let's compare our numbers on chart-topping new releases through October with the NPD's US spending on games from 2016 through 2019.

That's not the way it's supposed to work, right? Broadly speaking better games are supposed to sell more. That's admittedly an oversimplification and our comparison treats a massive hit like 2018's Red Dead Redemption 2 the same as a Naruto game that squeaks into the Top 10 one month and is never heard from again. Still, we wouldn't have expected to see the trends running opposite one another.

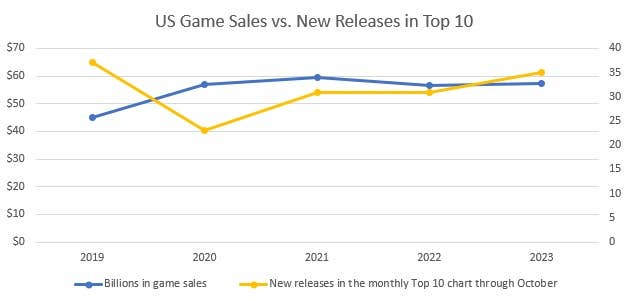

You may have wondered why we're looking at such a small range and it's largely because NPD started adding in mobile revenues in 2020 and those games vastly increase the reported sales totals but they aren't included in software charts.

NPD has reported a 2019 full-year figure with mobile included, and if we assume that the rest of 2023's game sales will continue at the roughly 1% growth rate they have shown to this point, here's what the more recent stretch looks like.

While 2020 backs up the chart above, the pandemic obviously had an outsized influence on both consumer spending and the number of big new game releases in 2020 and 2021. Those effects may be fading now, but I still don't think we've arrived at the new normal, and I'm reluctant to believe these last few years tell us much about any true relationship between the number of new games in the charts and overall consumer spend on games.

But if best-selling new games don't seem to impact the financial wellbeing of the games industry that much, is there any other bigger picture explanation for the ebbs and flows of the game industry's fortunes?

QUOTE | "It's the economy, stupid." – Bill Clinton's political strategist James Carville in 1992, emphasizing that the then-struggling economy was an issue that could tilt the underdog Clinton's campaign election over incumbent George H.W. Bush, who had sky-high approval ratings just a year before.

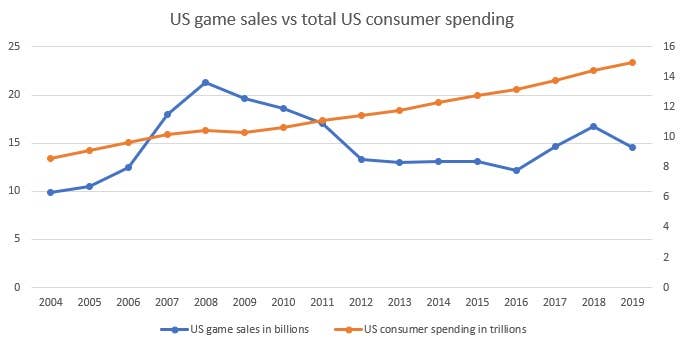

Ah yes, the economy, that most boring of reasons! Fine, let's look there if we have to. And to do that, we'll turn to the US Bureau of Economic Analysis, which tracks a whole bunch of information about Americans and money, including overall US consumer spending, which it reports as "personal outlays." If it's the economy that's determining game sales and not the quality of games, then we should see games thrive when people are spending more money, and recede when they aren't, right?

But that's America's secret. It's always spending more money.

US consumer spending has only declined twice since 2004, both times lining up with the kind of earth-shaking calamities that make you wonder just how strong the pillars of our society are and what kind of extras in The Road Warrior you might want to pattern your future after.

As you might have guessed, those two downturns were 2009 in the wake of the global financial crisis, and the pandemic kick off of 2020. Both times the declines were less than 2%, and more than made up for by the following year's growth.

Game spending, on the other hand, has been all over the map, rising and falling with almost equal frequency over the years, even as it has trended upward even faster than overall consumer spending.

So if best-selling games don't dictate overall sales and the economy doesn't, what's does?

Maybe it's actually good games? Absurd, I know. And quality is so much more subjective and messy a measurement, but it might do in the absence of more appropriate metrics.

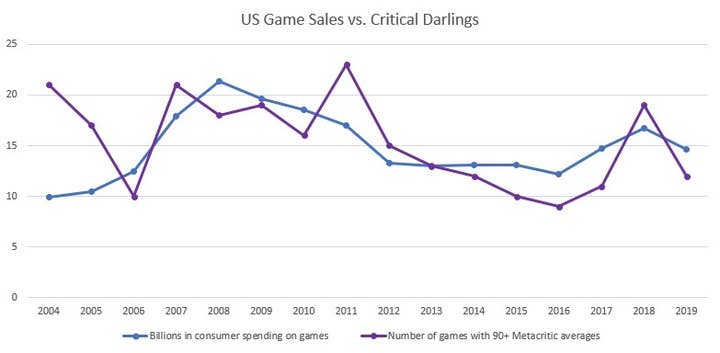

Fortunately, Axios already did some of the work for us last month, when it ran a similar exercise to the one above, testing whether 2023 has really been a good year for games by counting up the number of new releases with a Metacritic average of 90 or more on at least one platform each year since 2004.

Spoiler: It's been a good year.

STAT | 25 – The number of 2023 releases with a 90+ average, the highest in 20 years and basically double the average number for the past decade.

Because Axios' numbers go back to 2004, we can compare them against the NPD (and eventually Circana's) US spending figures to see if the flow of new commercial hits reliably lines up with game sales. We'll leave out 2020-2023 because of the pandemic effects, the inclusion of mobile games into the NPD's reporting data, and the absence of mobile games in Metacritic's review averages; the last 90+-rated mobile game we could find on Metacritic was 2017's Goragoa.

That… lines up pretty well, actually. But maybe it shouldn't. Digital distribution of games was growing from 2011 through 2015, but the NPD numbers were only reporting physical sales, so while the NPD numbers make it look like the industry was treading water from about 2012 through 2015 as the number of celebrated games declined, it was most assuredly growing significantly over that stretch if downloadable games on consoles and Steam had been taken into account.

This brings us to another familiar lamentation in this column: the state of games industry data. For years industry execs publicly squatted all over the NPD numbers for not covering social and mobile and digital distribution, upset that it was making a buzzy and growing industry look weaker than it really was.

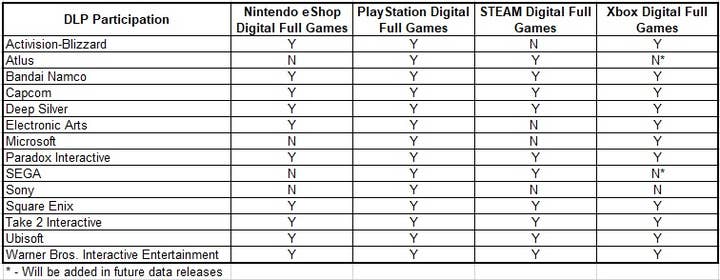

The 2020 switch to reporting comprehensive numbers including mobile, subscriptions, and all other consumer spending on games was maybe the final step in the company's decade-long effort to adapt, but it was far from the only one.

In 2016, NPD started including digital sales in its totals, but only from some publishers, and only from some platforms. Also, the platforms varied depending on the publisher, so if you wanted to see whose games were being counted on which storefronts, you needed a cheat sheet because the publicly available data in this industry is swiss cheese and every number we get comes with asterisks on top of asterisks.

So we've gone through a swath of data available to us, tried to make it fit in a number of different ways, and the closest correlate we found for industry sales was an amalgamation of subjective assessments shoehorned into an imperfectly assigned aggregate number. Swell.

Perhaps this is because there is no all-important factor that determines whether industry sales will grow or shrink from year-to-year. But it's also quite possible it's because the yardstick we're using to measure industry sales over this period – the NPD/Circana tally of US spending on games – simply hasn't been consistent or reliable enough for the span of time we're looking at.

Is it better now? I certainly hope so. At the very least, it is hopefully giving us data that is right or wrong in roughly the same way each year, so apples-to-apples comparisons can still be useful.

That said, I used to be able to tell you exactly where NPD got its numbers, because it was point-of-sale information from the country's biggest retailers. Depending on the year, Walmart wasn't playing nice so they would have to estimate it.

Now? That same point-of-sale information is there too, and some digital distribution numbers that some publishers feel like giving them, along with whatever method they have for sussing out subscription revenues and Sensor Tower's data from tracking people's mobile phones, which might make it tops for accuracy and creepiness in the Circana formula. (The Sensor Tower site does make a big show about how responsibly sourced and privacy compliant its data is, for what that's worth.)

This isn't intended as an attack on Circana. The industry has obviously grown too big for something like a point-of-sale solution to cover everything. There's just no clear way to track and report the myriad ways people spend money on games now, especially when companies consider every scrap of data they have to be an invaluable edge in an industry that holds every card close to the chest, no matter how meaningless it actually is.

I just can't help but shake the feeling that the bigger this industry gets, the less we can actually know about it.

The rest of the week in review

STAT | 78 – The number of consecutive months Mario Kart 8 Deluxe appeared in the NPD/Circana Top 20 sales chart since it April 2017 debut. That streak ended this week with Mario Kart 8 Deluxe finishing outside the Top 20 for October.

STAT | 0.6% – Newzoo lowered its full-year games industry forecast for 2023 to a 0.6% increase, down from its 2.6% expectation from August.

QUOTE | "The people that love Brisbane and love the scene in Brisbane really want to keep vitalising the scene. That's why I want to stay in Brisbane. I don't want to leave my community behind and we all want to be able to encourage other people coming into Brisbane, growing, and being a part of the community here." – Witch Beam producer Mei-Li C. talks about the Unpacking and Tampopo studio's aspirations, and why it would rather rebuild the local dev scene that collapsed in the global financial crisis rather than move to Melbourne.

Check out the rest of our Australia Games Week coverage to learn how the country's games industry is doing broadly, and then go in-depth with studios like PlaySide, Summerfall Studios, League of Geeks, Prideful Sloth, and Fellow Traveller.

QUOTE | "We've worked for many publishers and platform owners over the years and just felt like it was time for us to take on an ownership model and do things our way." – 3rd-Phase Boss managing editor Stephen Farrelly explains why he and fellow journalist Kosta Andreadis broke away from AusGamers to form their own operation, joining Aftermath, Second Wind, and Remap Radio as worker-owned media start-ups formed this year.

STAT | 7 – Worlds Untold is the seventh new studio NetEase has launched this year, because someone apparently missed the memo that 2023 is the year of bloodletting. Hyper-expansion is soooo 2021.

QUOTE | "It's never easy to part ways with talented individuals. I would like to put on record a special thanks to the people who have left Embracer in the quarter. These are difficult decisions and we do not take them lightly. For me, personally, it is crucial that the program is carried out with compassion, respect, and integrity." – Hyper-expansion avatar and Embracer CEO Lars Wingefors continues to grapple with the consequences of his own actions as the company confirms it has laid off more than 900 people as part of a restructuring this year and the company lost another $53 million last quarter.

QUOTE | "It's kind of like a snake that gets bigger and then regurgitates, gets bigger and then regurgitates, and just goes back and forth. It's been that cycle forever. And I don't see that changing. That's just human nature meets capitalism and a combination of long-term and short-term planning from larger companies." – Jordan Weisman, who has started and sold a handful of companies including FASA Interactive and Harebrained Schemes, believes the industry is getting better when it comes to smart acquisitions, but will always go through periods of fattening up and slimming down.

QUOTE | "Like many companies this year, we have experienced trends that required this restructure in order to ensure our long-term success." – In confirming layoffs, Humble Games emphasizes that all the other cool kids are doing it, so why shouldn't they?

QUOTE | "[Laying off 30% of our global workforce] will not impact the expected profit and loss statement for fiscal year 2023-2024, with no significant effect of the restructuring costs on the annual projected results, due to the savings resulting from reduced payroll costs." – Digital Bros confirms that it is laying off a third of the company in order to meet its forecast, but at least it won't have any significant impact on its results.

QUOTE | "We've listened to our customers, and we know delivering free games every month is what they want most, so we are refining our Prime benefit to increase our focus there." – Amazon Games VP Christoph Hartmann confirms the company is laying off 180 people, and gambling everyone will be cool with it because free stuff!

QUOTE | "As the single largest transaction in the video games industry, Microsoft's $68.7 billion acquisition of Activision Blizzard means 2023 is greater than the last two years of M&As combined!" – DDM underscores just how massive the Activision Blizzard deal was in its latest quarterly investment report.

QUOTE | "We have worked hard to deliver on this vision which has been years in the making. Anything said to the contrary is simply not true." – Sledgehammer studio head Aaron Halon responds to a Bloomberg report about the development of Modern Warfare 3 with a non-denial that is precise in its vagueness.

"We have worked hard" to deliver that game? No doubt, that's actually in the Bloomberg report, which talks about the studio crunching to make the game in 16 months. And he doesn't say Sledgehammer's version of the game was years in the making, just that the vision of this Modern Warfare 3 has been years in the making, and yeah, someone at Activision probably had the genius idea to make Modern Warfare 3 as soon as they decided to reboot the series numbering for 2019's Modern Warfare.

You really gotta watch what management there says carefully, as Sledgehammer developers probably already know considering they were reportedly promised they wouldn't be given another shortened development cycle after struggling with one on their previous game, Call of Duty: Vanguard.

STAT | 6 – Unity's next major update to its engine will change its numbering system from being tied to the year of its release in favor of a return to smaller version numbers, starting with next year's Unity 6.

It's an interesting marketing decision that might give the company an edge with particularly dim developers who see that Unreal Engine is only on 5 and reason that Unity 6 must be a more advanced piece of tech. On the other hand, Unity 6 could also be seen as an indication of just how little the product has advanced since it last used the version number system in 2017 with Unity 5.6.

STAT | 80 – The number of unionized employees at Sega of America whose jobs are planned to be "phased out" and outsourced by February, according to the Communications Workers of America union, which filed an unfair labor practice claim against Sega this week. The cuts represent 40% of the bargaining unit that was formed earlier this year when employees voted to unionize.

QUOTE | "What I noticed is, when I was paying for the therapist, a lot of what the therapist was telling me was, 'You gotta get out of this situation.' But when they hired the therapist, every other thing was comparable except there was never a recommendation for me to leave. And when I hinted at it, they were like, 'No, you can make it work. That's just one solution but it's not the best one, you'll find the same problems elsewhere.'" – Osama Dorias talks about the industry's evolution on the subject of burnout, and how the resources made available to employees are often still designed first and foremost to benefit their employers.