Pitfalls to avoid when looking for funding

1047 Games' Ian Proulx explores how to narrow down prospects, remove confusion, and speed up the funding process

If you're reading this, you might be ready to take the next step or are just starting out exploring your options to grow your company -- or maybe you're well along the way but feeling a little overwhelmed in negotiations. With so many types of investment deals it can be confusing to navigate.

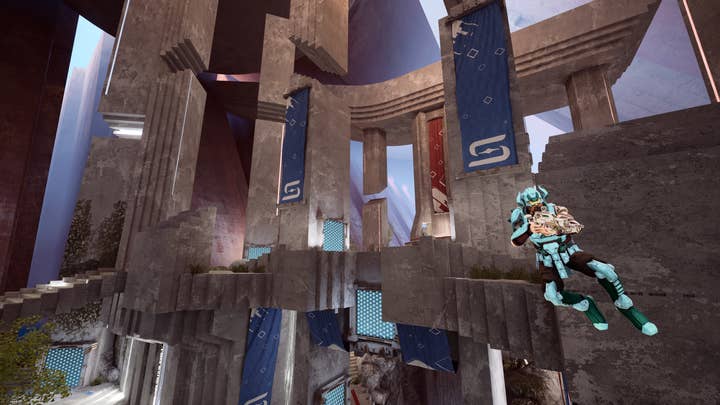

As CEO of 1047 Games, I started on portal shooter Splitgate while I was in college. We went from a bootstrapped student project to a fully-fledged PC and console live service game with a loyal fanbase and major VC-backed funding, but it did take time.

As a small but growing self-publisher and developer, I hope this article can help other founders avoid certain pitfalls and serve as a resource when you're looking to close a funding round. Hopefully this can help you narrow down prospects, remove confusion that surrounds the terms, and speed up the process.

The sooner you have funding for a deal that works for you, the sooner you can start expanding your product or service.

The opening conversation

I like to always start conversations with potential investors by telling our story. Investors (at least at the early stage) want to get a sense of how you got started, how you got where you are, and why you are doing what you do.

Investors are putting their faith in the team, so there are some do's and don'ts in these early talks to consider.

- Your story is your pitch

Telling the story of your company is a pretty easy and natural way to start the conversation to get them up to speed and hopefully generate excitement, but beware of being too casual. Investor meetings are about sizing you up as much as you're sizing them up.

Investor meetings are about sizing you up as much as you're sizing them up

Try to formulate your company's story into an engaging and memorable part of your pitch. Don't hide anything, and never lie, but also try to emphasize the positives and position the negatives as something you've identified and are addressing.

In our case, we focused on our "superstar" team, rather than the fact that we were fresh out of school with little or no experience. We also stressed our data-driven approach, something many gaming companies are lacking, and something most investors loved to hear.

- What you say now could come back and bite you later

Try to share enough information to get investors excited, but don't overshare.

Don't set too many concrete expectations: if you share overly optimistic expectations about performance or financial projections, and get turned down (which you probably will), it makes it hard to go back a year later to share progress if you've now created a situation where it seems like you underperformed.

The investor might wonder why you didn't hit those initial targets and now you're in a bad spot.

- Don't go negative -- things could not be better!

No matter what challenges you may be facing, it is imperative that you keep a positive and confident outlook. Body language, a confident pitch, and a "things could not be better" attitude are necessary for what could be a long early phase as you search for the right investor.

Friends in low places: Networking, PR, lawyers and bankers

Casting a wide net and knowing the value of a third-party endorsement are key areas to focus on in the early talks with VCs. Dig deep in your list of contacts to find relationships that might prove valuable in initial introductions.

Reach out to old acquaintances, college buddies, and co-workers to find who might have connections that might be helpful. That includes lawyers, bankers, investors in other industries -- you never know who might be a good referral -- and it might only take one to find the right future partner.

- Don't be shy

Networking is huge. Don't close off future opportunities by only focusing on one or two VC firms -- talk to as many as possible. And realize that you'll likely not get a meeting or perhaps even a response from many of them.

The more you practice your pitch to investors the more you'll learn about what resonates with them and what doesn't. Investors may also introduce you to more investors (even if they decline investing themselves ), and this helps expand your network by a large margin.

I was extremely jetlagged, but I knew some potential investors would be there, so I got out of bed, had a shot of espresso, and went

In our case, Lakestar was the first investor to actually commit to participating in our round, and it all started with me going up and talking to a group of strangers at a meet-and-greet at the startup/tech conference Slush in 2019.

I was extremely jetlagged and almost didn't attend the event that night, but I knew some potential investors would be there, so I got out of bed, had a shot of espresso, and went.

Though I didn't know anyone at the event, I struck up a conversation with everyone I could. One of those people ended up being an avid Halo player and a partner at Lakestar. That was the beginning of a long relationship with the Lakestar team, who ended up not only investing, but also introducing us to loads of other potential investors and partners, and most importantly being our champion and advocate as we navigated the very challenging road to closing funding.

- Publicity is a third-party endorsement

PR and publicity can definitely give you credibility early on, and the endorsement of third parties in the form of positive media articles can help push an investor into the "yes" category.

Prior to our first round of funding, we managed to show signs of early traction, including some preview articles from gaming outlets that spoke about Splitgate's potential and over 15k alpha sign ups for our game.

The key for our team was to be scrappy and creative to get the traction and credibility we needed to get angel investors interested.

- Do get a good lawyer

Lastly, you definitely need a good lawyer -- closing a deal can be a lot of work. It's also important to keep your diligence locker up to date as you go so that you don't have dozens of files (or people) to track down when it's time to close.

- Do not hire a banker (yet)

One kind of professional help you should NOT have on your team early on is an investment banker. Bankers can be helpful in later rounds, but early stage investors want to deal with you directly, and they want to know that you are capable of raising money, since it is a very important skill to have for a CEO.

I know a number of early stage investors who won't even consider investing in a company if they have a banker representing them for this very reason.

So you have a big fish on the line -- is it the right fish?

Don't say yes to funding out of fear. Say yes because it's a deal that makes sense for you.

Don't say yes to funding out of fear. Say yes because it's a deal that makes sense for you

There were three types of funding we explored: publishing deals, VCs, and strategic investors. Each has its pros and cons, but it's important to partner with people who share your long-term goals.

In our case, our long-term vision is easily communicated and understood: we want to be a multi-game studio with multiple hits, and to ultimately go public, so VCs were the best route. Knowing who you are and where you're going and confidently pitching those things goes a long way.

- Confidently pitch your vision

Investors need to hear your elevator pitch. Keep it engaging, succinct, and consistent with your vision. Avoid losing early interest and get your pitch down before you have these types of conversations.

1047 wants to own its own IP and build its company. We talked to both strategic investors and VCs, and in the case of strategics, their interests were not aligned with ours. We were not looking to get acquired, but instead wanted to go big on our own. There's no right or wrong answer, it just depends on what your goals are.

Courtship phase: Do's, don'ts, can's, and shouldn'ts

- Do's

Always be selling. Talk to as many investors as you can. Make it a numbers game: the more people you talk to, the more likely it is one of them will be a good match for an investment.

- Don'ts

Avoid siloing your conversations with other investors. Don't keep it a secret you're talking to other investors -- this is critical to create "buzz." The investment community is smaller than you think, and you never know which investors know each other.

Knowing basic etiquette and ethics about what you can say, what you can't or shouldn't say can help you in the long term. Never burn bridges, but also know when a deal is not for you and be prepared to walk away.

Avoid siloing your conversations with other investors. Don't keep it a secret you're talking to other investors

- Can's

It's important to keep potential investors updated and excited about your progress, but also let them know your deal may not be around for long.

It is almost always in the investor's best interest to just wait things out and see what happens, and no one wants to be the first person to offer to invest. That's what makes it tricky. You must always be clear and honest, and you should make sure to "sell" your company in the best light possible.

- Can'ts

Once you do get an offer, it's not ethical to share those terms with other investors and shop the deal around (but you can let other investors know that you have an offer and need to make a decision quickly).

Know when to fold 'em, know when to run...

Closing a deal on average takes about a month or often longer. Thankfully, our investors were easy to work with, so there wasn't a ton of back and forth or negotiating once high level terms had been agreed to, but that isn't always the case. Knowing when to walk away can make all the difference.

One investor that we had come to an agreement with ended up spending months renegotiating the deal, even after we had agreed on the terms. It seemed that every conversation brought a new change. Ultimately, we ended up walking away. This was a difficult decision, especially given the time we had invested, but it was the best decision for our company.

Negotiating terms is a huge part of the process -- and can be lengthy -- and this is when having a good lawyer becomes key to your financial future. In our experience here's some fun (read: terrible) things investors may try to put into the term sheet, and depending on your situation and future goals this could be disastrous for your company.

- Call Options are a non-starter

One thing strategic gaming investors may try to slip in is a call option, which is an option to acquire your company in the future at a price set today. This should be an absolute non-starter for a number of reasons.

A call option caps your upside, which is bad, but it actually has even worse implications than that. A call option practically makes it impossible to ever raise money again. If I'm a Series B investor, I'm not going to invest in your company in the hopes that I double or even quadruple my money because your company can simply get acquired at some predetermined price by your first investor who holds the call option.

You not only cap your upside but you also preclude any future investments from anyone other than the holder of the option.

- Golden handcuffs

Investors are going to want the C-level leadership to stick around for a while after they invest, and hopefully you do too.

Depending on your own personal goals, your comfort level with committing to re-vest your options or signing a years-long agreement clause may vary. While it's reasonable for an investor to know that the leadership team will be around for a while, there's a balance as to what you are comfortable agreeing to.

- Avoid deadlocking by negotiating

We covered some terms that should be immediate no-go's, but closing is a process of negotiation in general, so avoid an impasse if you can and shoot for a win-win when possible.

Some investors are win-lose negotiators, where they try to get as good a deal as possible with no regard for the founders. These are not people you want to work with. If you are dealing with an investor who is being greedy or overly demanding, and you don't have alternatives, it is a tough spot to be in, and it really comes down to if you can afford to walk and take the risk of having nothing.

A year ago, we were in that exact situation where an investor tried to re-trade the deal and we negotiated for 6 months and failed to come up with something that we were comfortable with. Ultimately we were deadlocked. It was a tough decision to walk away from it because we had no alternatives, but thankfully it paid off and we ended up with great investors and long-term partners with similar goals.

If you do kill the deal and walk away, avoid burning bridges and leaving on a sour note. It's important to always maintain relationships. It's a small industry and you never know who you will end up working with down the line.

Hopefully this has given you some key takeaways as you navigate through your courtship and closing phases. It's helpful to keep in touch with the investors you meet along the way -- you may be looking for your next round sooner than you think. By being aware of potential pitfalls when you're in your early rounds of fundraising, this can hopefully guide you to a smoother and quicker successful round.

Ian Proulx is the CEO and co-founder of 1047 Games, developers behind the online portal game Splitgate. A lifelong gamer and avid fan of first person shooters and the game Portal, Proulx developed Splitgate as a student at Stanford University for a class project. 1047 Games is a dispersed studio with its HQ based out of northern California.