Augmented and virtual reality consumer content market hits $3.2bn

Virtual reality install base expected to reach 75.7 million by 2021

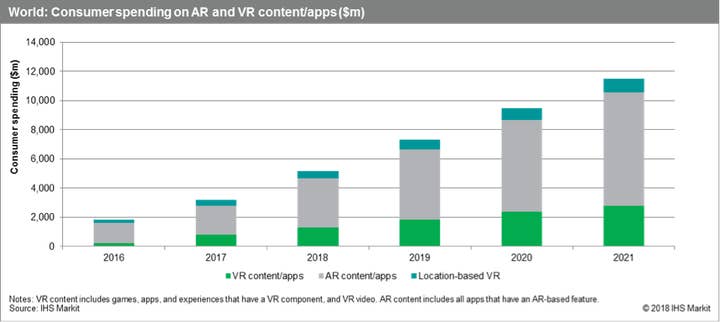

Growing by 72 per cent in 2017, the augmented and virtual reality consumer market reached a value of $3.2 billion according to analytics firm IHS Markit.

With a steadily increasing user base investing in more content, apps, and location-based VR entertainment, 2017 was a strong year for the business.

Projected growth estimates the VR global install base will rise from 28 million to 75.7 million by 2021, and that revenues will reach $5.9 billion.

The market for VR remains relatively niche at present, with consumer AR's market potential expected to significantly outstrip it over the next five years.

However, with hardware price drops, advancements in the tech, and more appealing content, VR headset adoption rates should continue rising.

Growth in VR is hampered though by the limited adoption of high-end PC and console headsets.

According to an IHS Markit report -- Immersive Computing: Consumer Augmented and Virtual Reality -- many independent VR content companies selling directly to consumers have found it difficult to realise a return on their investments.

The report found that market performance for AR and VR was underpinned by several key factors.

First is the the popularity of apps that include AR feature ranging from entertainment, games, retail, and social media, which reached consumer spending of $2 billion last year.

Interest was spurred following the release of high-profile software development kits with Google's ARCore and Apple's ARKit, the latter of which has an install base alone of 375 million.

The adoption of high-end VR headsets, which saw numbers rise from 18 million to 28 million in 2017, has encouraged more active consumer spending.

A sudden flurry of big-budget console and PC games with VR modes, such as Resident Evil 7 and Fallout 4, has also helped drive consumer engagement.

Finally, 2017 saw a significant increase in location-based VR entertainment with the number of venues rising by 52 per cent, up to 8,945 globally.

Although the consumer VR headset market continues to grow, it does so at a sedate pace, the IHS Markit reported noted.

Restrictions on market growth were hardware cost and lack of "standout content", while smartphone VR was undermined by limited support for Google's new Daydream platform.

"The consumer AR market is inherently better positioned than VR, because AR features are relevant to a wider cross-section of content and application categories," said Piers Harding-Rolls, research and analysis director, IHS Markit.

"A smartphone-driven AR market offers a huge addressable audience, but this scale will be offset to an extent by the more limited use cases for handheld and small-screen dedicated AR experiences."