A better way to grow? | This Week in Business

Whether live service companies plan to grow revenues by getting more users or increasing spending per user, they often wind up in the same place

You ever see something so awful that your first instinct is to show it to someone else, so they can share in how awful it is? Even though you know it's probably just going to make their day worse?

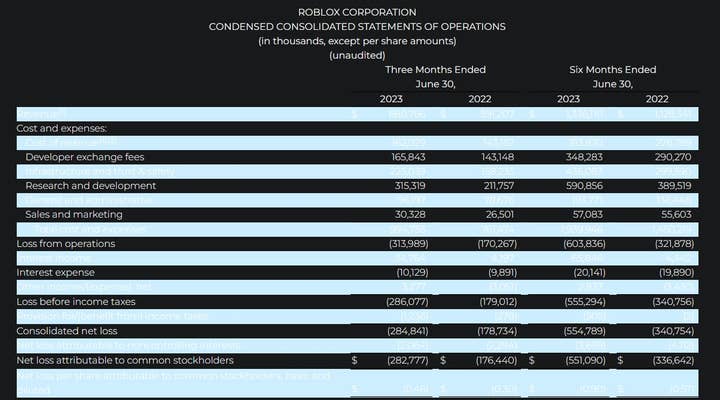

I sure hope so, because that will make me feel a little better about showing you this:

That's from Roblox's latest quarterly earnings report. I have seen companies shade every other line of the tables in their investor relations materials for readability in the past, but I've never before seen someone do it for unreadability. White text on a light blue background? That stands out as much as a GameStop employee who hates their job.

While that table left the biggest impact on me, it wasn't the only part of Roblox's earnings report that got a raised eyebrow.

QUOTE | "Given the geographic and age diversity of our userbase, along with investments in our product, we are confident that we are building a platform that could, over time, grow to support one billion DAUs (daily active users)." – Roblox lays out a longer-term target for the platform.

STAT | Less than 66 million – Roblox's DAUs for the most recent quarter, a number that has nearly doubled since the beginning of the pandemic. At this rate, we're only about four more pandemics away from Roblox hitting 1 billion!

Obviously, Roblox will have to grow immensely to reach its goal. And considering the company has never had a profitable quarter because it spends so much of the money it brings in to fuel additional growth, I'm not terribly optimistic the business will actually make money anytime soon. In fact, Roblox shares my position on that point.

QUOTE | "Since our investment decisions are generally based on levels of bookings, we expect to continue to report net losses for the foreseeable future even as we anticipate generating net cash provided by operating activities." – Roblox in its earnings report.

For the purposes of this discussion, bookings is basically sales, and Roblox's loss-leading growth strategy has certainly worked to grow sales over the years.

But with a live service game where people can technically spend limitless amounts of money, there are two paths to growing sales: you either attract more players (obvious, acceptable), or you take more money from the players you have (greedy, exploitive).

So even though Roblox has been accused of those latter traits plenty in recent years, its growth plan looks more like the former once you put aside that whole child-labor-paid-in-company-scrip thing.

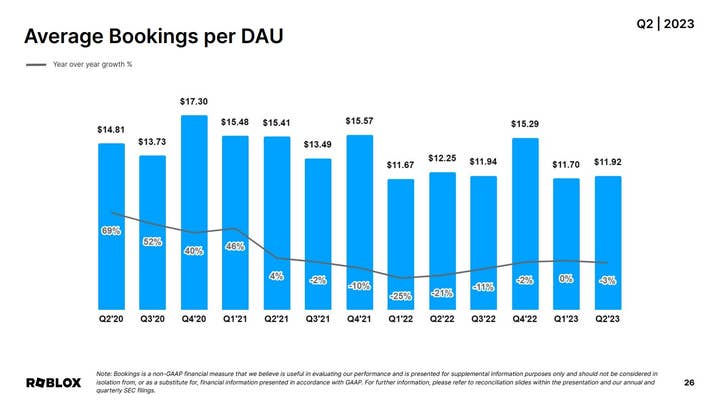

The placement of that year-over-year growth % line does a good job of obscuring the fact that Roblox's average bookings per DAU have been down year-over-year in seven of the past eight quarters, with the lone exception rounding down to 0% growth. (This is still more easily digestible information in historical context than most game companies report about their average bookings per DAU though, so credit to Roblox on that front at least.)

It makes sense for DAU and average bookings per DAU to head in opposite directions because non-spenders are naturally less invested and more likely to churn. But I'm still surprised Roblox's monetization – which boomed in the first year of the pandemic alongside the userbase – has stalled out ever since, especially as the company's userbase has shifted significantly older to audiences with more disposable income and autonomy to make purchasing decisions.

STAT | 54% - The percentage of Roblox's userbase that was under 13 in the first full quarter of the pandemic.

STAT | 41% - The percentage of Roblox's userbase that was under 13 in its most recent quarter.

Roblox is not alone in trying to grow by targeting a larger audience instead of pulling more money from the audience it has.

Take-Two has emphasized a desire to grow the recurrent consumer spending (virtual currency/DLC/in-game ads) part of its business for years, and Take-Two CEO Strauss Zelnick told us this week he would rather hit those targets by reaching the broadest audience possible instead of reaching deeper into players' wallets.

QUOTE | "You can have a great experience, but if it feels like you overpaid for it, it taints the experience and you don't want to repeat it. We never want consumers to feel like they spent too much, even if they got something they loved for it. So our goal is not to max out what a consumer can spend; our goal is to entertain consumers and reach as many consumers as we can." – Zelnick says Take-Two is less aggressive about maximizing spend per user than many of its competitors.

That might be a little surprising considering one of Take-Two's big money makers is the NBA 2K series.

QUOTE | "This game is a hustle. And the hustle is everywhere, from the moment you try to improve your player to big splash screens advertising card packs right down to every time I try and leave the game, where the next menu item down after 'QUIT' is 'BUY VC.' None of this is new, of course. VC made its debut all the way back in NBA 2K13, so for a decade 2K have been grabbing players by the shorts, flipping them upside down on the court and shaking them until all their lunch money falls out, and players just keep on coming back, year after year." – Kotaku's review of NBA 2K23.

But it's downright shocking considering Take-Two is the parent company of Zynga after acquiring the mobile specialist last year.

QUOTE | "We've done so much experimenting at Zynga with VIP. We know what's the frequency of contact. We know what call types work. We know what times to call. We know exactly who to call and when. We know who has a higher propensity to be more susceptible to our call." – Zynga vice president Gemma Doyle talks about the company's VIP program in a Game Developers Conference session from earlier this year. The VIP program identifies big spenders (and people whose behavior suggests they could be big spenders) and works to maximize the amount of money Zynga gets from them.

Until its acquisition by Take-Two, Zynga was also pursuing growth at the expense of the bottom line, acquiring company after company and adding their revenue to the pile while posting huge losses.

On a superficial level, the strategy Roblox and Take-Two are publicly embracing seems preferable, because it's the nice guy pitch that free-to-play advocates have always made. Everybody gets to enjoy a great game, and only those who feel it's worth it actually pay (or keep paying, in the case of premium live service games like NBA 2K23).

But the reality is that no matter how much faith you have in Roblox and Take-Two's statements of intent, for companies of this size, the difference between the good-natured live service approach and the greedy one may just be timing.

No matter how impressive it is to actually reach the addressable audience, investors and executive compensation packages won't exactly welcome the plateau

The addressable audience for any product is only so big, so eventually Roblox, Take-Two, and any other company with live service offerings will find that growth trails off. But no matter how impressive it is to actually reach the addressable audience, investors and executive compensation packages won't exactly welcome the plateau. And if growth can't come from expanding the userbase, extracting more money from the users you already have is the obvious alternative.

What's more, all that respectable growth you did in building the userbase pays off even more once you make the switch since there are so many more players to put the screws to. (You can read the column about that Zynga GDC session linked above for details on the exceedingly skeezy ways companies do that, too.)

It's actually ideal to do it in this order, because once you start squeezing every last dime out of the existing audience, growing the userbase is probably going to be much more difficult, if not impossible.

But if you've already hooked people with a quality product and become a habitual part of their lives, it's remarkable how much worse you can make your product before they finally cut their losses and leave. Just look at what has happened to Google, Amazon, Facebook, Netflix, Twitch, Uber, and Twitter. They have all degraded their main selling point in the name of shoving more ads into users' faces, or charging more, or taking a larger slice of the pie. Each has gotten demonstrably worse over the years, yet the number of people who have actually cut ties with them is in most cases minimal.

There's a debatable exception to the "nobody leaves" point for X/Twitter, but when it comes to actively destroying a company, nobody can hold a candle to what Elon Musk has done (possibly because igniting such a massive concentration of methane fumes would be catastrophic).

It's not that free-to-play and live service games can't be run sustainably with ethical practices, because I think a fair number have managed to do that. It's that the business models around them lend themselves so much better to that not happening, especially at the scale of a publicly traded business with aggressive growth targets.

There's a reason companies the size of Electronic Arts and Warner Bros have handed off their old MMOs to the likes of Broadsword Online and Standing Stone Games. It's not that games like Ultima Online, Star Wars: The Old Republic, or Lord of the Rings Online can't make money anymore; it's that they aren't likely to make any more money than they already do.

And at that point, whatever modest money they reliably bring in year-in and year-out only makes the growth curve big companies are hoping to get from the rest of the business a little bit flatter.

So if Roblox or Zynga seem aggressive now when the focus has been bringing in more users at the expense of the bottom line, I'm morbidly curious what they'll look like once the focus pivots to bringing in more per user.

Italy Games Week in review

STAT | 2,400 – The number of people employed in Italy's games industry in 2022, up 50% year-over-year.

QUOTE | "I founded this company ten years ago, and it was basically a fucking desert out there. There's almost a games industry now." - Valerio Di Donato, the CEO of Redout studio 34BigThings, was one of the Italian developers we spoke with for a bigger picture view of the state of the Italian games industry.

QUOTE | "Our role model is [Bayonetta developer] PlatinumGames because they have their signature style, they do things in-house, they do important collaborations, but every time they release something there's always a lot of interest, and you can always see their style in there." – Reply Games product manager Samuele Perseo details the ambitions of the Italian studio behind Soulstice.

QUOTE | "We felt the need to create something that was ours, that was bringing our DNA to something… Because we are not only developers, we are craftsmen. We like always to say that." – Ubisoft Milan producer Cristina Nava explains why the studio was happy to leave the Just Dance series behind to lead development on Mario + Rabbids.

QUOTE | "[Italians] come from a legacy of poets and artists. We have a very, very artistic approach to things and an Italian way of doing things. We are trying to show that... while also maintaining the international approach on how we design and write games because, of course, they are meant for everybody, not just for Italian people." – Like many of the Italian developers we spoke with, Stormind CEO Antonio Cannata was eager to put the country's cultural stamp on the industry.

The rest of the week in review

STAT | 800,000 – The number of concurrent players Baldur's Gate 3 on Steam during the game's launch weekend.

QUOTE | "This was all Altagram group. We reached out and compelled them to fix this." – Baldur's Gate 3 developer Larian wasted no time in blaming localization outsourcing company Altagram after translators who worked on the game were omitted from the credits. Altagram confirmed it had left freelancers out and Larian would allow them to add the missing names in an upcoming patch.

QUOTE | "Flavourworks' technology and interactive video expertise will enable us to efficiently create story-based games and reach more people through streaming and new platforms." – Telltale CEO Jamie Ottilie explains why the company acquired Erica developer Flavourworks.

QUOTE| "We believe that there is ample possibility for us to catch up." – Sony president and COO Hiroki Totoki says PS5 hardware sales have been weaker than expected, but should still meet the company's stated goal of 25 million units sold for the year.

QUOTE | "Our families are our top priority and they should not be affected negatively by our work." – Darkwood developer Acid Wizard Studio is going on hiatus, leaving open the possibility of returning in five or ten years.

STAT | 9,182 – The number of registered players at the Evo fighting game tournament last weekend. The tournament for the just-released Street Fighter 6 drew more than 7,000 competitors on its own.

STAT | 11 months – The span of time between Embracer Group announcing the creation of narrative RPG studio Campfire Cabal and the studio confirming its impending closure.

QUOTE | "We also noticed a positive psychological aspect for our team members. Many eligible people commented positively on the changes being made, even if they had no need to take advantage of the benefit. It is because the idea of being able to take an additional day off, if needed, gave them comfort." – GOG head of PR, communication and culture Gabriela Siemienkowicz says the decision to offer a day per month of menstrual leave had a positive impact on employees, even though only 16% of the allowed menstrual days were actually claimed.

STAT | 2.6% - Newzoo's projected growth in worldwide consumer spending on games in 2023, a welcome return to positive territory after 2022 was down 4%.