UK Industry braces for Brexit impact, with 40% considering relocation

UKIE study finds British studios primarily concerned over access to talent

An extensive report conducted by UKIE, published this morning after presentation to MPs and Peers in Westminster, has highlighted an industry bracing for the impact of Brexit, with many expecting our uncertain future to have a negative effect on the ability of British games companies to do business.

In fact, 40% of respondents to research conducted for the report say they are considering the total or partial relocation of their business to another country as a direct consequence of the referendum result.

Collecting data from 75 UK firms across the spectrum of our industry, backed up by direct consultation, roundtable events and expert advice, UKIE has compiled a 55 page study of the perceived effects of Britain's withdrawal from the EU, alongside a raft of proposals on how best to mitigate the economic uncertainty and isolation from labour markets which the manoeuvre seems likely to generate.

"We have a strong foundation on which to build, but must ensure we achieve a positive outcome from the negotiations to secure the continued growth of the British games industry"

Chris White MP, Chair of the APPG for Video Games

By collecting the concerns of the industry's leading domestic lights and presenting them to government, accompanied by a timely reminder of their scale and profitability, UKIE hopes to bring the needs of developers, publishers and other UK games businesses to the fore of negotiators' minds when conducting the post Brexit trade deals which will sculpt the immediate fiscal future.

"We know that evidence is key to informing policy and want the information presented in this report to inform the direction that the country will follow both in our upcoming negotiations with the EU as well as our ambition to become a truly Global Britain - home to top diverse international talent, pioneers and innovators from the tech and creative industries who'll shape the world ahead," reads an opening statement from UKIE CEO Dr Jo Twist OBE.

"The UK games industry blends the best of British innovation and creativity and we have the opportunity to lead the world in AI, VR, AR development through what we do in the games industry. We look forward to working with Government to seize the opportunities in key areas such as skills, immigration and public funding reform to create a 21st Century globally competitive future."

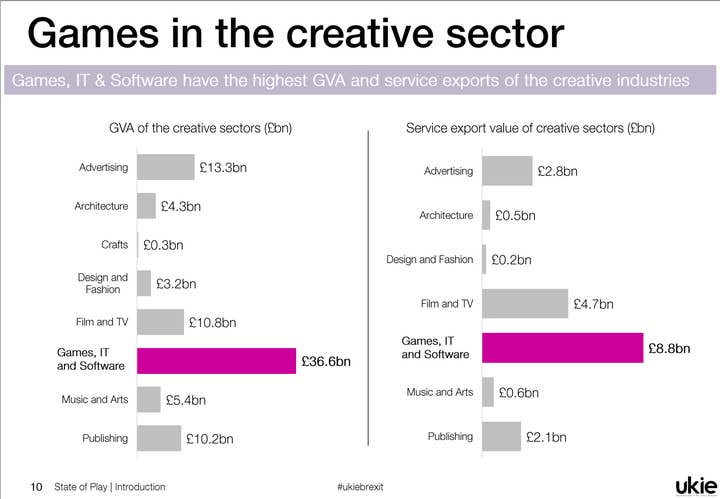

Going on to highlight the growth and volume of the domestic consumption and production of games and games services, the report then identifies the four key areas which are considered to be the most potentially vulnerable to changing regulation post-brexit: availability of talent, market access, data flow regulation and access to funding.

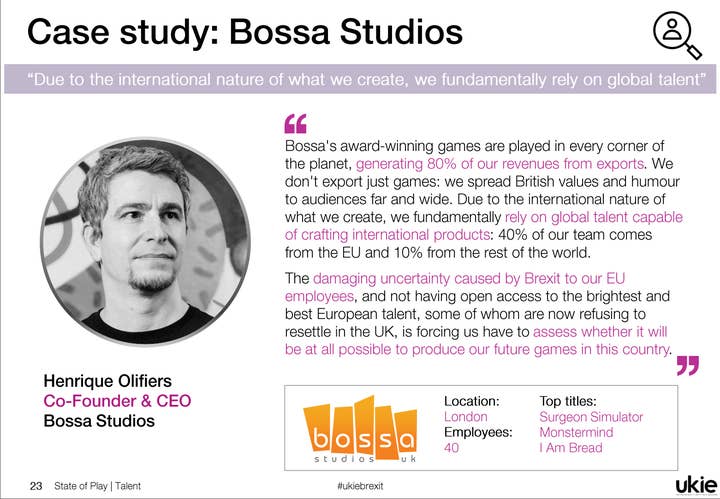

Of those companies consulted, 61% said they relied on international talent. 35% of the workforce of those companies comes from the EU and 17% from elsewhere in the world. 40% of respondents said they had already noticed more difficulty in recruiting and retaining these overseas workers as "Brexit is perceived as weakening the UK's attractiveness as a destination."

"It is vital that we maintain friction free access to all major markets and talent"

Warwick Light, VP and MD, SCIEE

Given that such a high percentage of the UK industry's employees are non-native, ensuring that foreign workers are able to either join the workforce or remain here if already employed in the UK is considered to be a top priority. Opting for the optimistic view that "the UK's departure from the EU is seen as an opportunity to redefine our immigration laws to position the UK as home to the best technological and creative international talent," the report makes clear that maintaining the pipeline to well educated and highly-skilled, highly-sought after employees from both the EU and elsewhere is critical to the continuing success of the British games economy.

In addition, the need to ensure a proper flow of graduates with the proper skillbase for the industry's needs was highlighted, with 65% of games businesses saying that they had "hired international talent due to a shortage of the right skills in the UK."

Nonetheless, the immigration process should become more flexible, adaptable, accessible and friction free, says the paper, calling for an expansion of the Tier 5 Temporary Worker Visa, and end to the Immigration Skills Charge and extensive reformation of the Tier 2 shortage occupation lists and resident labour market test.

Market access proved to be another thorny issue. Although few companies are feeling the squeeze of non-tariff or financial barriers to trade yet, retailer GAME cautioned that this ease of trade must be protected in forthcoming negotiations. As an industry with both physical and digital markets, games is especially vulnerable to vicissitudes in the regulation of imports and exports.

"Funding for UK games development should be globally ambitious"

Alex Fleetwood, CEO, sensible Object

However, some respondents felt that the change in formal trade agreements could result in a better position for the UK in the long run, as a strong production market drew in favourable deals from major consumption territories and high growth areas such as China and Brazil.

Because of the vast amounts of data which is produced and trafficked by the operation of modern games, having to separate UK figures from the general data stream is considered to be prohibitively expensive by many, with one company going so far as to say that the necessity to do so would give it cause to consider whether publishing games in the UK was worthwhile at all.

Lastly, the paper considers the importance of securing access to existing international funding and the establishment of new sources of money. As well as the preservation of initiatives which directly influence games companies, such as the video game tax relief, respondents felt it was important to consider the knock on effects of factors such as inner-city regeneration funds which have provided the infrastructure upon which to create new industry. Other EU-based funds such as Creative Europe were cited as key to success, with Brighton studio The Chinese Room expressing concern that such programmes remain open to British companies in the future.

Of course, as with all things related to the ever-mercurial, and often seemingly illogical, manifestations of Brexit policy negotiation, much of what can be discussed and prepared for now remains conjectural. Nonetheless, without proper study of, and preparation for, the potential fallout from Britain's departure from the European Union, our industry will remain at the mercy of forces which, historically, haven't always had our best interests at heart.

Noirin Carmody, UKIE chair, makes clear that the scale of the task ahead is not lost on the UKIE management.

"Brexit raises a number of challenges in these and other areas," Carmody observes. "Challenges that will affect not just the games industry but the wider technology and creative sectors that games sit within. It is therefore vital that government considers how leaving the EU will impact these sectors, if the UK is to remain a world leading destination for creative, high-tech, knowledge-intensive companies that will continue to succeed in the 21st century. We hope that this report provides valuable evidence and clear recommendations that will assist policy makers in the months following the triggering of Article 50."

Download your copy of 'The UK games industry's priorities for the EU negotiations' here.