Holiday sales no longer "make or break" - DFC

Firm sees softness in console market but games-as-a-service having "profound impact"

Analysts at DFC Intelligence have released their Holiday 2016 research brief and provided an overview to GamesIndustry.biz. The company lowered its forecasts slightly for both PlayStation 4 and Xbox One, noting that PS4 should still eclipse 50 million units worldwide, however, and that Xbox One will probably fail to hit the 30 million target this year that DFC had originally anticipated and will instead see flat results year-over-year.

The firm is also becoming more bullish on Nintendo's Switch, noting that there's "significant excitement about a new game system from Nintendo and lots of talk about Nintendo among both the older generation and their kids," thanks to the Pokemon success of late and the NES mini. That said, David Cole cautioned, "However, we are still concerned that Nintendo management is not really prepared to take full advantage of that good will. They have really struggled with overall strategy and product launches the past few years."

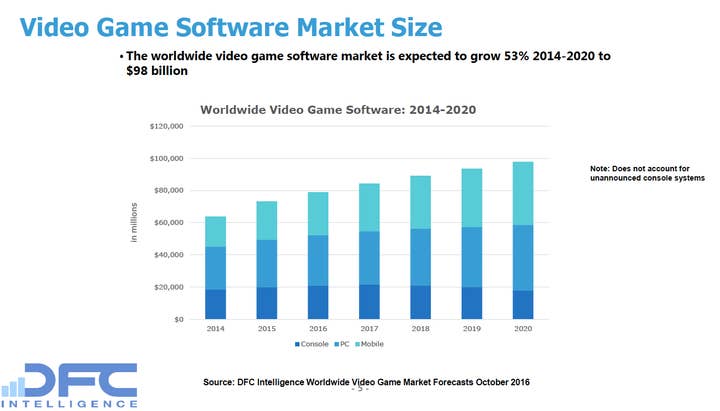

Hardware aside, the key theme to the research brief on the software side is the growing importance of recurrent revenue. As you've already seen, there's been a lot of talk of sluggish results at retail, even from big AAA titles like Call of Duty: Infinite Warfare. While that means that launch numbers are down from the blockbuster records we've seen in years past, the games-as-a-service model is having a noticeable impact, making seasonality much less important.

"As for recurring revenue, in the console market close to 40% is likely to be from online revenue streams in 2016 with the biggest one being add-on content that releases after a game's initial launch. Even a company like Take-Two Interactive is reporting that nearly 40% of revenue is now from 'recurrent consumer spending.' Activision Blizzard of course has the Blizzard and King division that is all about recurrent spending products," Cole noted. "The Q4 holiday rush is still important; it is just not make or break for most of these companies. The downside for a Call of Duty or Titanfall 2 is fewer initial sales mean less recurrent revenue but we think it is still possible to add consumers after a product launches. A slowdown in CoD or other products simply means Activision needs to work harder promoting the product after the initial blast."

As big tentpole releases move more and more in the direction of becoming year-round products, the publishers' stocks should be less volatile too. "Long-term game software stocks will become more stable and less subject to day trading," DFC stated in its report.