New approach by Valve pays dividends in Steam Winter Sale

"More customers bought more games across more of the Steam catalog"

A report, seemingly leaked accidentally by Valve, has indicated that a different approach to the annual Steam Winter Sale reaped rewards for both developers and the platform holder, increasing sales and engagement across the board.

The report was initially posted in the private Steam user group, but later appeared briefly on the public SteamVR forum, where it was diligently recorded for prosperity by SteamDB founder xPaw. In the report, Valve lays out the reasoning behind a different approach to the discounting of games over the festive period - specifically the lack of the usual 'flash sales' in which games are steeply discounted for short periods on rotation. Instead, games had a single discount applied over the course of the entire sale, meaning that customers weren't 'hovering' over a game's buy button, waiting for a price cut that might never come.

"Our hypothesis was that this new format would be a better way to serve customers that may only be able to visit Steam once or twice during the 13-day event," the Valve post explains. "We also saw this change as an opportunity to showcase a deeper variety of titles to customers each day, while having confidence that any game being highlighted would be at its lowest discount.

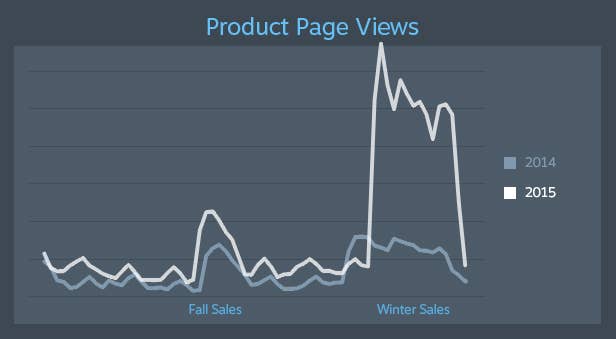

"As a result of this format change, we were able to encourage customers to browse through their Discovery Queue, thereby surfacing a string of personalized recommendations including titles that aren't otherwise highlighted on the home page. By dropping users a free Steam Trading Card for browsing through their personalized Discovery Queue (up to three times each day) many customers were exposed to 36 different product pages every day for each of the 13 days of the event.

"This resulted in three times as many views of product pages as in past sales events."

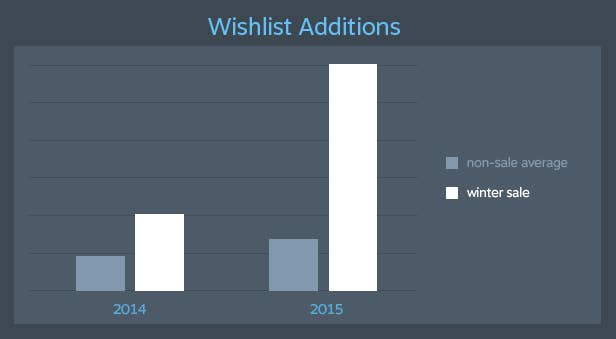

By increasing the use of the discovery queue, Valve says that it not only upped the page views of a wider variety of games, it also increased engagements - both actual sales and marking games for a wishlist. Whilst both have shown increases in previous sales, there was a marked rise with the new approach. Wishlist additions were up 197 per cent over non-sale periods, whilst revenues themselves were also up more than usual, particularly for those games which fall outside of the service's best performers.

"As with past years, popular hits continue to sell well during major sales events," the post continues. "But what about the thousands of other titles on Steam? We looked at performance of the group of games outside of the Top 500 in revenue terms. This group collected 35 per cent of product page traffic during the sale, which is over 4x their share of traffic from the previous winter sale. And these weren't just idle views - we also saw 45 per cent growth in the revenue generated by this group of games as compared with the last winter sale."

The results, whether they were ever intended to be publicly available or not, echo findings from a study into the impact of the implementation of the Discovery update published in March. Then, it was made clear that the addition of the semi-curated Discovery queue was encouraging a democratisation of visual traffic as players were guided towards games which would appeal to their tastes, but may be too niche to ever break the front page.

"Thanks to the Discovery Update, customers appear to be getting better and more personalized information, and acting on it," said Valve employee Tomg in a post at the time. "In addition to the raw increases in traffic, we've also carefully monitored sales data to make sure we're growing the size of the pie, rather than just adjusting the size of the slices. Steam's overall growth doesn't just come from the biggest hits (which continue to see great success), but also from the smaller titles that are now better able to reach the audience that is right for them. To look at smaller titles, we dug into revenue for all apps outside of the 500 top sellers. Within that subset, total revenue has increased 18 per cent and daily earnings per app have increased by 5 per cent, even with 400+ new apps joining the store since the Discovery Update."

The figures represent continued progress in the complex and divisive process of curating a rapidly expanding catalogue which has so plagued many other platforms - most notably mobile app stores. Steam's approach definitely seems to be working, and working in a way which shows benefits to the consumer, a wider array of developers and Valve itself, hopefully facilitating a healthy storefront supporting a broader church of better quality games and games companies. Although Steam doesn't operate under anything like the same volume of submissions which Apple or Androids platforms do, there are almost certainly things which both mobile giants could learn from this approach should they wish to emulate the results.