India: The Power of One Billion

The world's fastest growing mobile market remains relatively untapped - but tread lightly, there still be dragons

India is the birthplace of four world religions, the numerical system, cricket cheerleaders, and some damn fine food.

Within this one landmass, we also speak over 1,600 languages and play host to an ever-shifting menagerie of varying sub-cultures, tastes, and religious sensitivities.

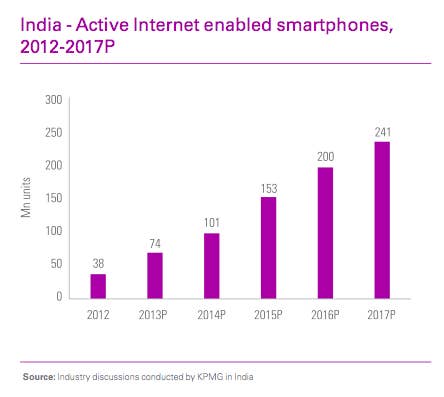

But the uniting factors are compelling and increasingly exciting for our industry: over 940 million mobile users at last count (with 200,000 more connecting every day) and 4G coverage rapidly expanding. India is a mobile-first market, and it's this mobility that is connecting the nation at an exponential rate.

Add in a recently elected, mobile savvy, foreign investment-friendly Prime Minister - Narendra Modi - and the stars have aligned to create a massive untapped new market for developers.

Perhaps most importantly, we love entertainment, and we especially love games. From chess to Diwali cards, play has been deeply woven into the DNA of the Indian diaspora for millennia.

With that in mind, here are a few starters-for-10 for any developers looking to delve deeper into this giant minestrone of bubbling and untapped potential.

The Good News!

1. Scale and Growth

The raw numbers are staggering: India is already the world's second biggest mobile market and 200,000 new users are added daily - a trend that's actually accelerating. But how accessible and valuable are these users in real terms?

The reality is that up until recently, mobile user growth was both focused in the six major Tier 1 metropolitan cities. Secondary growth was driven by fragmented and hard-to-reach rural pockets with carrier-owned ecosystems and local incentives. However, all that is changing, and fast.

Mobile penetration in dozens of Tier 2 ( population of around 3M+, or the size of Los Angeles) and Tier 3 (1M+, or around the size of Liverpool) cities is now growing faster than the six major urban centres, and Tiers 4 and 5 aren't far behind. These previously fragmented markets have exciting new potential driven primarily by technological and cultural consolidation that are inherent with mobile connectivity.

2. Technical infrastructure

The "last mile" infrastructure bottleneck has been an issue for over a decade. The up side is that wireless connectivity has already become the de facto standard with the previous 3G spectrums and recently launched 4G standards growing fast. That's good news for users of mobile devices, and for content creators looking to reach mobile-native users anywhere and any time.

Much like other emerging mobile markets, India is also primarily Android driven, with Android devices accounting for 98% of the smartphone market. iOS accounts for less than 2 per cent, largely because Apple only started operations recently (with a major advertising blitz across the nation) - but also due to the proliferation of high quality, locally manufactured, and much cheaper devices from OEMs such as Micromax (in a campaign fronted by Hugh Jackman doing his best not to look awkward while saying "it's nothing like anything," bless him).

3. Cheaper User Acquisition

A common problem the more established mobile markets have is content saturation and discovery, leading to cost-per-install estimates of $2.73 (SuperData), with an average ARPU of just $1.96. That ratio gets significantly worse during holiday release windows.

CPI estimates for India are significantly lower - for now - at around $0.45 for your average Android user (MediaNama.com). With less content saturation also comes more opportunity for organic virality, with 2,000 to 3,000 downloads needed on a given launch day to enter the Play store top ten (and one tenth that for paid games). From there, the natural force multipliers we know and love start to kick in.

With our partners the biggest successes have come from building up relationships with a network of key tech influencers such as NDTV (like CNN in India) Cell Guru, Honey Singh (best name ever), and local OEMs such as Micromax, who can be more open to pre-loading your game on new device launches.

The Bad News...

Mobile payments remain an issue for monetisation - that is at least, if you plan on using the same monetisation toolbox we've been used to in the West.

Credit card penetration is still comparatively low, and while universal carrier billing does enable frictionless payment opportunities, up until recently the revenue split has been frankly prohibitive (90/10 - to the carrier).

On the plus side, in-app mobile advertising is generally accepted - even appreciated - and there are other avenues for distribution and monetisation popping up increasingly. Some carriers (with Vodafone India leading the way) have even created special direct-to-consumer carrier billing programs with a more equitable 60-40 revenue share, though many would argue this is still not close to far enough.

A Final Word

As we head into E3 week, developers continue to ask the question of where growth will come from in our industry - not just where, but how to tap into it, and how to get there efficiently and with a game's creative integrity intact.

While big budgets and F2P model variants continue to drive value for the big publishers and studios like Gungho and Supercell, there's another option: one half way around the world, but a lot closer than you think. Consider India as ready for prime time.

Justin Shriram Keeling is a 14-year industry veteran having launched and sold gaming businesses in London, Tokyo, Los Angeles and India. He consults with developers on new market strategies with a focus on India and Japan at Lumikai, and recently launched into beta a proprietary India-based distribution, loyalty and monetisation platform at www.playsona.in.