Gamers rule: Only 10% of the industry's $50 billion comes from casuals

The Game Monetization Summit offered some crucial advice from key players and discussed the secrets of whales

The Digital Game Monetization Summit in San Francisco had a number of speakers and panels that not only presented opinions and analysis, but also refreshingly presented us with some specific numbers and examples. Since digital distribution is generally opaque, getting some insight into the amount of money being made, and how, is vitally important. The following overview hits some of the high points of the varied array of presentations.

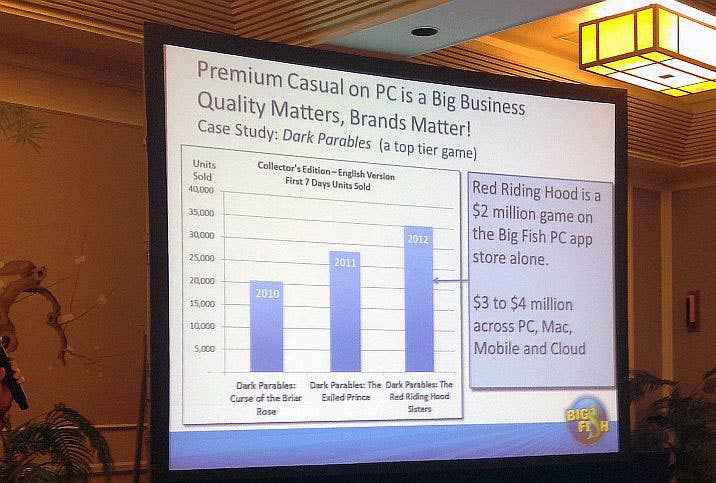

Paul Thelen, CEO of Big Fish, offered a look at the lessons Big Fish has learned from the business of casual games. Big Fish has been profitable all through its 11-year life span, and continues to grow at “healthy” double-digits. Thelen noted that while the PC is not considered a growth platform, Big Fish is still adding audience for its PC games - so it's a growth platform for them. According to Thelen, Big Fish is making money with a variety of business models, from premium casual games sold for $19.99 to free-to-play games. Thelen's key advice is to try and continually reinvent yourself. “Just because we made money doing this last year doesn't mean we will make money doing this again next year,” he noted.

“You need to match the game mechanic to the business model, and the monetization needs to match the business model of the game,” Thelen said. “If you have a game that has 6 to 8 hours of linear gameplay and when you finish it, you're done, there are very limited ways you can monetize that game. What we've done is a simple transaction; you buy it, just like you would buy a book. It's very hard to monetize a book with free-to-play.” Big Fish provides a variety of price points for its games, ranging from a $19.95 'collector's edition' to a standard edition at $6.99 or $9.99, as well as subscriptions and free-to-play.

Big Fish is planning to launch some 250 games in 2013, and Thelen said that almost all will have a positive return on the PC. Big Fish now is in the process of bringing many games to mobile; Thelen points out that a high production value game for Big Fish, which would cost about $500,000 to produce, can be ported to the iPad for about $20,000. “Now you have a half-million dollar game on a hyper growth platform, and that game has already returned a profit to the developer,” Thelen said.

Thelen provided some eye-opening numbers about the state of the business. “Free-to-play is a huge market, and there are people making crazy amounts of money,” Thelen said. “Supercell came from nowhere after a lot of mistakes, and they are now making $300 million on two games on iOS alone.” Thelen also noted that free-to-play games reach 1.2 billion PC users, and that 14 million gamers are visiting Big Fish each month, so there's plenty of room for growth.

"Just because we made money doing this last year doesn't mean we will make money doing this again next year"

Paul Thelen, Big Fish

The next session featured panelists talking about the business of games, and they noted some astonishing statistics. For example, mobile hit Temple Run quintupled its revenue when it switched to a freemium model. While many have focused on creating casual games for the greatly expanded demographics available through social, online, and mobile platforms, some of the panelists felt the opportunity lies elsewhere.

“If you look at what people successfully did on Facebook or the early days of mobile, a lot of it was about cheap user acquisition through the spammy virality that Facebook allowed for a while, or manipulations of the terms of service from Apple or Google on the mobile side. That's gone away,” said Greg Richardson, CEO of Rumble Entertainment. “Of the $50 billion that was spent worldwide last year on games, less than 10 percent was spent on casual content. These companies were really smart around analytics and monetization and very light in terms of product and content creation. I'm not sure any of those things are particularly sustainable. The future lies in going into the larger part of the market which is people that self-identify as gamers, and where the user acquisition and long-term value creation comes from making great games.”

The following panel talked about stickiness, or game mechanics that keep players playing, and Mark Long, CEO of Meteor Entertainment (creators of Hawken) outlined how Meteor made some key changes to its game. “In our closed beta exit survey, we saw a lot of players play one session and leave, and this concerned us,” said Long. “We came up with the idea of what we call Newbie Island; your first five sessions you're only playing new players, so there's a safe place for them to not get their asses handed to them and hopefully get the them to come back after that first session.” Long also pointed out a game that does a great job of getting new users into the game. “CSR Racing, I've never seen onboarding that's so flawless.”

Another panel took on the subject of online gambling, or “real-money gaming” as it is more politely termed, and what that market will offer in the future. At the moment it's already a $35 billion market, so it's no wonder that companies like Zynga are very interested in moving into it. The legal status is changing, as states are moving to allow real-money gaming. Delaware already allows most anything, according to the panelists, and Nevada is next up. Putting the games online means easy access for anyone. Will this open up the demographics to new players? George Zaloom, CEO of GoPlay, was blunt. “They have to. The typical Vegas operator is concerned about their traditional customer base, which ranges between the ages of 50 and 75. They see the traditional social gamer as this young mom who's sophisticated, who's technology savvy, and likes to play games. If they can migrate that customer from being a free-to-play player and bring them into their real-money space, that's a new way to save their business.” The difficulty ahead for Zynga is that large, well-funded casinos and operators like IGT are aiming for this market, and they're not about to just hand it over to Zynga without a fight.

"The first harsh reality is: CPIs [Cost Per Install] are only going to go up"

Nick Bhardwaj, Natural Motion

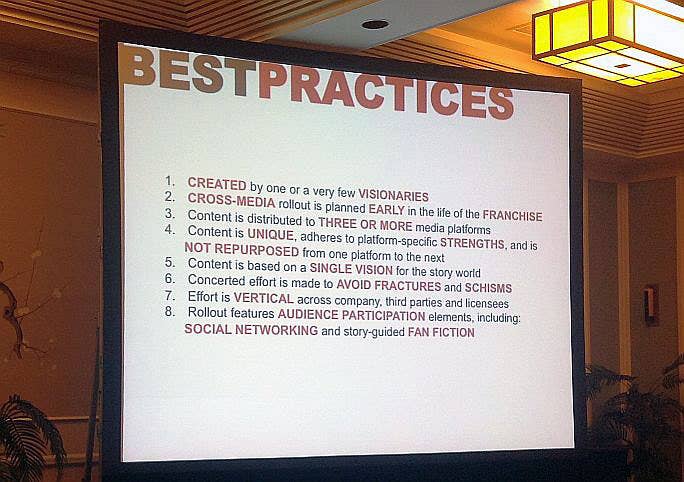

The next talk saw Mark Long of Meteor Entertainment return to the podium to talk about Hawken's transmedia approach to marketing. Long showed a picture from Hawken, and asked the audience “How many of you know what that is?” Most of the audience raised their hands. “That's amazing to me, since we spent zero dollars on advertising,” Long said. He then proceeded to talk about how they had achieved high awareness through a mostly viral approach. “For a company that has raised $28.5 million we are still perceived to be an indie Cinderella story,” said Long.

Hawken has been a success at gathering attention (and signups) because of the transmedia approach, Long said. This means creating a coherent story across multiple media, told out of order; The Matrix is a good example of this, with comics, games, animation as well as the movies driving multiple impressions and connecting the stories in a larger universe. Long discussed the creation of a 20,000 word story bible to seed the game, a feature film now in production, a graphic novel, prose novels, and anime, all being rolled out over the next few years. Crucially, all of the media is optimized for search engines, embedded with analytics, and driving all traffic to one web site: playhawken.com.

Nick Bhardwaj, the VP of monetization for Natural Motion, took to the stage to talk about the acquisition costs for CSR Racing. The title is the #1 app in 75 countries, and brought in $12 million in revenue during its first month - while spending precisely nothing on acquisition costs. Bhardwaj explained the importance of K-factor, the viral coefficient; that's the number of new users brought in by each user. Bhardwaj discussed the basic loop for games: Do a thing, get a thing, and expand your things, then repeat. For instance, that might be running a race, getting an award for that race, and using that award to purchase more components for your car. His basic advice was to look for ways to get people to share content; pictures of their tricked out car, for instance, shared on Facebook or Twitter will lead to more people trying out the game. Such natural customer acquisition is best, Bhardwaj said, because as he put it:

“I was in mobile advertising, I understood user acquisition, I understand all the price points, and the truth is, it's a shitty industry,” Bhardwaj said. “It really is. The first harsh reality is: CPIs [Cost Per Install] are only going to go up. You think they're high now? It's going to be just like gas prices. Right now, average CPIs in the industry on the weekends are over $2, $3. There have been previous weekends where I've seen major players bid upwards of $10 per install. This will only go up for two reasons: new entrants, and cash influx from Asia. There are a lot of great companies in Asia who've been doing great games in Japan, China, and Korea, who now want entry into the US. Next you're going to see the influx of real-money gambling apps. The LTVs [Life Time Value} of those customers are hundreds and hundreds of dollars, 10x, 20x higher than anything you see in even the greatest mobile games. I would assume by the end of Q2 next year you're going to see average CPIs above $5.”

It's going to be a tougher market, and Bhardwaj advises careful management of K-factor to help succeed in it. Track where your game installs come from, figure out what gets people to recommend your game, and strive to build the best game you can that naturally encourages people to share it with their friends.

"The other thing that's really important, besides big spenders, is commitment really matters"

Emily Greer, Kongregate

The next panelists talked about monetization strategies for emerging regions, and had some interesting data to present. According to NPD's Anita Frazier, one-third of gamers in the US have played free-to-play games. About 15 percent are aware of free-to-play games but have never played, and about 8 percent of the players have paid for items in free-to-play games. The first month is crucial to paying; if a player hasn't paid in that time, they are unlikely to spend money later on. Localizing your strategies for different countries is important; one example given was the $60 tank in World of Tanks. When the game was brought to China, local advisers suggested making the tank gold, and charging $100 for it; the result was that sales were even higher for that tank than in Russia. Generally, there seems to be strong growth in Eastern Europe and Latin America, and developers are looking for ways to take advantage of that. Working with local experts is crucial to success, the panelists advised, so find people who really understand local markets to help maximize your game's potential.

DFC Intelligence analyst David Cole moderated a panel on in-game advertising, wondering if the time is right for advertising to make serious inroads into providing revenue for developers. Many free-to-play games monetize just a few percent of their players; can ads help monetize the rest? While there has been some success with video ads, especially when players are given a choice to opt-in in order to gain access to a game or rewards, it's not a universal solution. For one thing, there's not a huge inventory of ads available; advertisers have yet to fully embrace the medium of games. Mobile games are even more problematic. Still, panelists felt that we're likely to see more ads in and around games, especially as companies like Zynga and King.com work to generate more revenue from the huge numbers of players. Greg Mills, VP of marketing for Goko, said “I do think Zynga will soon start doing pre-roll ads for users who virally don't invite a lot of new people,” Mills said. “If you look at the number of impressions that would generate, it would be huge. It's going to start with the large companies that have a massive audience, then it will trickle down.”

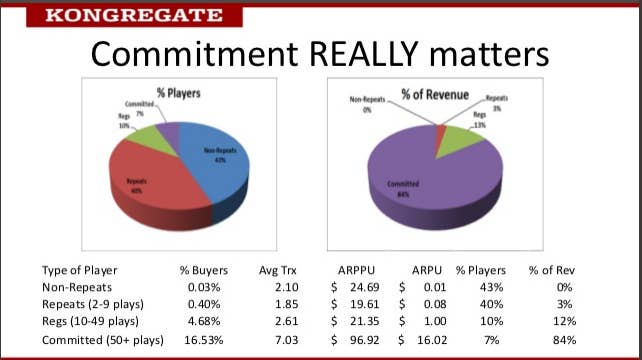

Finally, Emily Greer, COO and co-founder of Kongregate, provided a look at some of Kongregate's top games. Greer noted that while many developers think of consumables as being the best type of virtual item, consumables only account for some 10-30 percent of sales. The best items from a developer's standpoint - that is, the ones that generate the most revenue - offer some permanent capability, Greer said.

Kongregate's data shows the importance of the steady player. “The other thing that's really important, besides big spenders, is commitment really matters,” Greer said. “We divide our player base on a game into four categories: Non-repeats, players who come into a game once and bail; repeats who play a game between 2 and 9 times; regulars who play between 10 and 49 times, and the committed players who play 50 or more times. For the top ten games, the 7 percent who are committed are 87 percent of the revenue.”

Sales may spike revenue, but Greer cautions that it's just moving the revenue forward, not actually increasing it. “When games have problems, they are either not getting players deep enough into the game or they don't maximize what they can get from players,” said Greer. It's important to get players committed to a game, and when you do, to make sure there are good reasons for them to continue to spend money later in the game.

Most whales spend less than $1,000 or $2,000 in a game, but there are some who have spent “in the tens of thousands,” according to Greer. “The average buyer on Kongregate has spent on about 3 games, but the whales are a little higher at about 4.5, but their spending tends to be extremely concentrated on one favorite game. Most of the big spenders have about 90 percent of their spend on one individual game.”