Stock Ticker: Activision Blizzard

Bobby Kotick's pronouncements may infuriate gamers - but do they really delight investors, as is so often claimed?

Having covered the most valuable games company in the world, Nintendo, in the first instalment of this series a few weeks ago, let's now look across the Pacific to the second most valuable - Activision Blizzard.

In a sense, it's extraordinary that a third-party publisher could even come within knocking distance of challenging the valuation of a successful platform holder of Nintendo's stature. There are certain financial considerations to bear in mind with regard to that - not least of which is that Activision is listed on New York's technology-stock focused NASDAQ, whose investment culture is a world apart from that of Japan's markets - but it still stands as a testament to the sheer strength of the franchises on which Activision has built its business, being primarily Call of Duty and World of Warcraft.

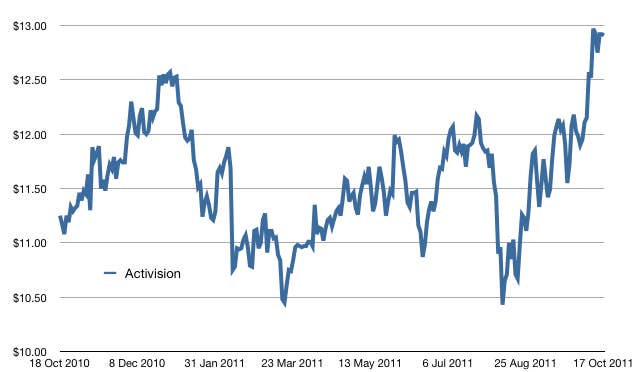

Activision, in contrast to the companies I've focused on so far in this series, hasn't had a bad year at all. Its graph over the past year is a bit bumpy, certainly, but there's a clear seasonality to it. ATVI's valuation peaked towards the end of 2010 as the extraordinary success of Call of Duty: Black Ops became apparent, before falling off through spring and summer - only to begin an even sharper rise as autumn rolled in and excitement began to build around Modern Warfare 3.

That's where we stand now with Activision. The stock is trading close to $13, which would be the highest price it's reached since the financial crash of 2008. If last year's trend is repeated, though, it's likely to grow through the next couple of months as well, and some US analysts suggest that a price target of $15 is reasonable. That would actually bring Activision's stocks up beyond the levels it was trading at following the announcement in late 2007 of the merger with Vivendi (and thus, more importantly, Blizzard). The company's shares shot up at that time, and traded at around $14 for several months before heading skywards to roughly the $17 mark when the deal went through in July 2008.

For investors, NPD's headline figures are cold facts, and can't be healthy for Activision's share price.

Those gains were wiped out in the wake of the financial crisis, but three years later, Activision appears to be on the verge of returning to its pre-crash levels - a feat to which few companies in the games business can lay claim. To do so in the face of the constant flow of negativity surrounding retail game sales is even more impressive. Industry insiders know, of course, that much of the lost retail sales are instead flowing through digital channels (and that the rise of revenues from digital distribution, freemium, subscription and other such models probably even outweighs the decline of retail), but for investors, NPD's headline figures are cold facts, and can't be healthy for Activision's share price.